The NJSVCC is here to help all small businesses, regardless of veterans status, file their SBA disaster loans. We will also help you fill out the paperwork associated with SBA requirements. You really shouldn't try to do this on your own. Please reach out to speak with one of our small business outreach manager's to talk through the requirements. You can reach out to connect to one of our outreach manager's by emailing us at info@njveteranschamber.com.

COVID-19 Information

Great information put out from Senator Corey Booker's Office about COVID3 funding:

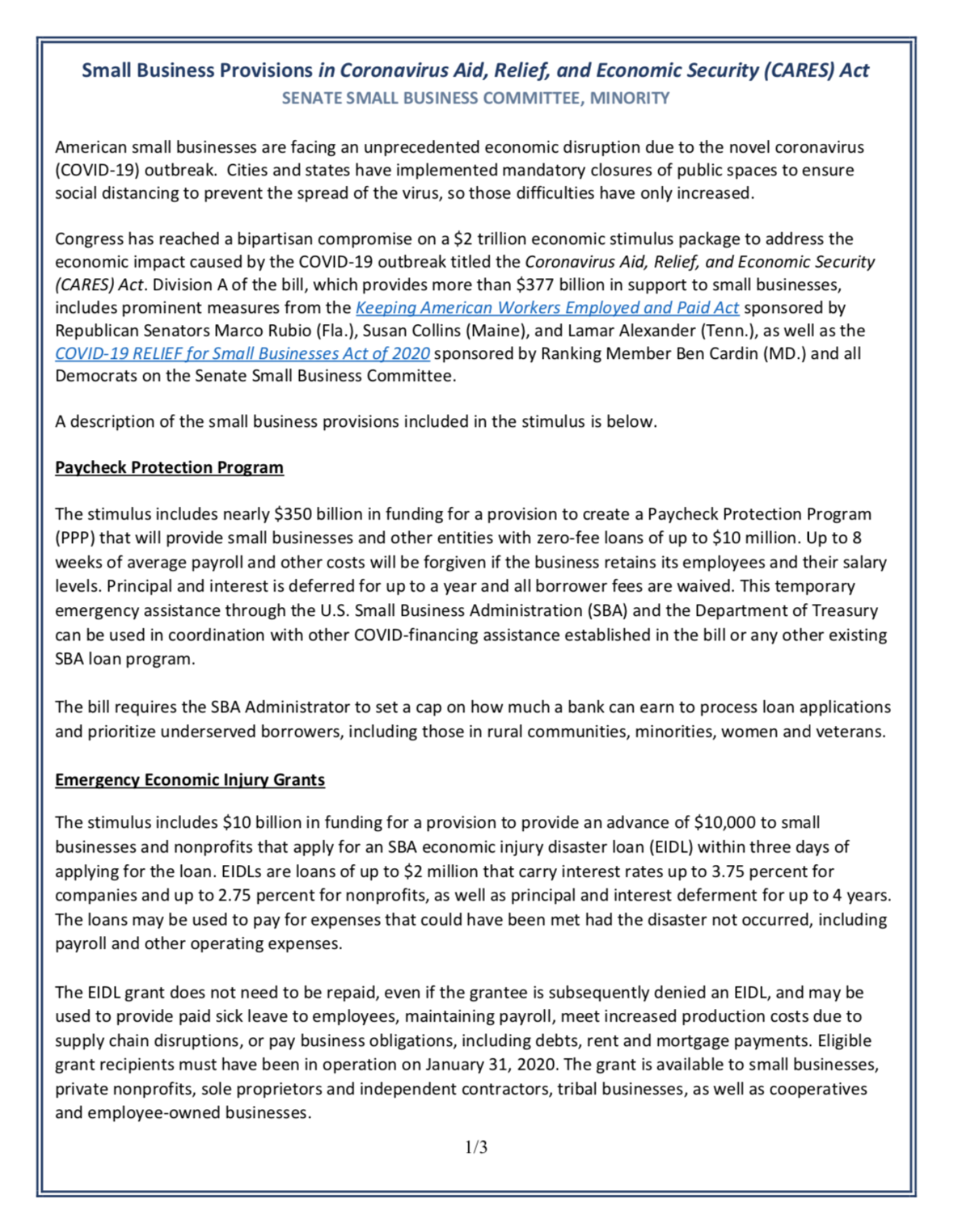

Sec. 1102: Paycheck Protection Program

Sets the government guarantee of loans made for the Payment Protection Program under section 7(a) of the Small Business Act to 100 percent. This does not apply to other 7(a) loans. Outlines the terms in this section, such as defining eligible payroll costs. Provides the authority for the Administrator of the U.S. Small Business Administration (SBA) to make loans under the Paycheck Protection Program. Requires the Administrator to register each loan using the taxpayer TIN, as defined by the Internal Revenue Service, within 15 days. Defines eligibility for loans as a small business, 501(c)(3) nonprofit, a 501(c)(19) veteran’s organization, or Tribal business concern described in section 31(b)(2)(C) of the Small Business Act with not more than 500 employees, or the applicable size standard in number of employees for the industry as provided by SBA, if higher. Applies current SBA affiliation rules to eligible nonprofits and veterans organizations for purposes of determining size. Includes sole-proprietors, independent contractors, and other self-employed individuals as eligible for loans. Makes eligible businesses with more than one physical location, as long as it has no more than 500 employees per physical location in certain industries. Waives affiliation rules for businesses in the hospitality and restaurant industries, franchises that are approved on the SBA’s Franchise Directory, and small businesses that receive financing through the Small Business Investment Company (SBIC) program. Defines the covered loan period as beginning on February 15, 2020 and ending on June 30, 2020. Sets the maximum Paycheck Protection loan amount at $10 million, with each borrower’s loan size based on a formula regarding their payroll costs. Defines the allowable uses of the loan proceeds to payroll support – such as employee salaries, paid sick and medical leave, and insurance premiums – as well as mortgage interest, rent, and utility payments.

Extends delegated authority, which is the ability for lenders to make determinations on borrower eligibility and creditworthiness without going through SBA’s channels, to all current 7(a) lenders, and extends that same authority to new lenders that join the program. For eligibility purposes, instead of requiring lenders to determine repayment ability, which is not possible during this crisis, lenders will only need to determine whether a business was operational on February 15, 2020 and if it had employees for whom it paid salaries and payroll taxes, or if the borrower is a paid independent contractor. Provides the U.S. Department of Treasury temporary authority to approve new lenders to make Paycheck Protection loans through the 7(a) loans. Allows a borrower who has an EIDL loan related to COVID-19 and made on or after January 31, 2020 to apply for a Paycheck Protection loan, with an option to refinance that loan into a PPP loan up until the end of the covered period for PPP loans (June 30, 2020). However, the emergency EIDL grant award of up to $10,000 would be subtracted from the amount forgiven under the Paycheck Protection Program. Existing EIDL borrowers not related to COVID-19 are also eligible to apply for Paycheck Protection loans for payroll assistance, but they may not refinance into a Paycheck Protection loans. Requires eligible borrowers to make a good faith certification that the loan is necessary due to the uncertainty of current economic conditions caused by COVID-19; they will use the funds to retain workers and maintain payroll, lease, and utility payments; and that the borrower does has not have an application pending for another 7(a) loan for the same purpose and is duplicative of amounts applied for or received under a Paycheck Protection loan, and that between February 15, 2020 and December 31, 2020, the borrower is not receiving funding from another 7(a) loan for the same purpose. Waives both borrower and lender fees for Paycheck Protection loans that typically apply for regular 7(a) loans. Waives the credit elsewhere test for borrowers seeking a loan under this program. Waives collateral and personal guarantee requirements for borrowers under this program. Outlines the treatment of any portion of a loan that is not used for forgiveness purposes. The remaining loan balance will have a maturity of not more than 10 years, and the guarantee for that portion of the loan will remain intact. Sets the maximum interest rate for Paycheck Protection loans at 4 percent, whether the loan is made by an SBA lender or Treasury-approved lender. Prohibits any prepayment fees charged to borrowers.

Mandates that SBA require all Paycheck Protection lenders to defer payments for at least six months and not more than a year. If a Paycheck Protection loan that has been sold on the secondary market, and the investor will not defer payments, SBA is required to purchase the loan and provide deferment of payments for at least six months and not more than a year. Requires SBA to disseminate guidance to lenders on this deferment process within 30 days. Allows Paycheck Protection loans to be sold on the secondary market and prohibits SBA from collecting a fee. Provides the regulatory capital risk weight of loans made under this program, and temporary relief from troubled debt restructuring (TDR) disclosures for loans that are deferred under this program. Requires the Administrator to provide a lender with a process fee for servicing the loan. Sets lender compensation fees at 5 percent for loans of not more than $350,000; 3 percent for loans of more than $350,000 and less than $2,000,000; and 1 percent for loans of not less than $2,000,000. Further, it includes a sense of the Senate for the Administrator to issue guidance to lenders and agents to ensure that the processing and disbursement of covered loans prioritizes small business concerns and entities in underserved and rural markets, including veterans and members of the military community, small business concerns owned and controlled by socially and economically disadvantaged individuals. Provides an authorization level of $349 billion for the Paycheck Protection program through December 31, 2020. Increases the maximum loan for a SBA Express loan from $350,000 to $1 million through December 31, 2020, after which point the Express loan will have a maximum of $350,000. Requires Veteran’s fee waivers for the 7(a) Express loan program to be permanently waived. Permanently rescinds the interim final rule entitled, “Express Loan Programs: Affiliation Standards” (85 Fed. Reg. 7622 (February 10, 2020)).

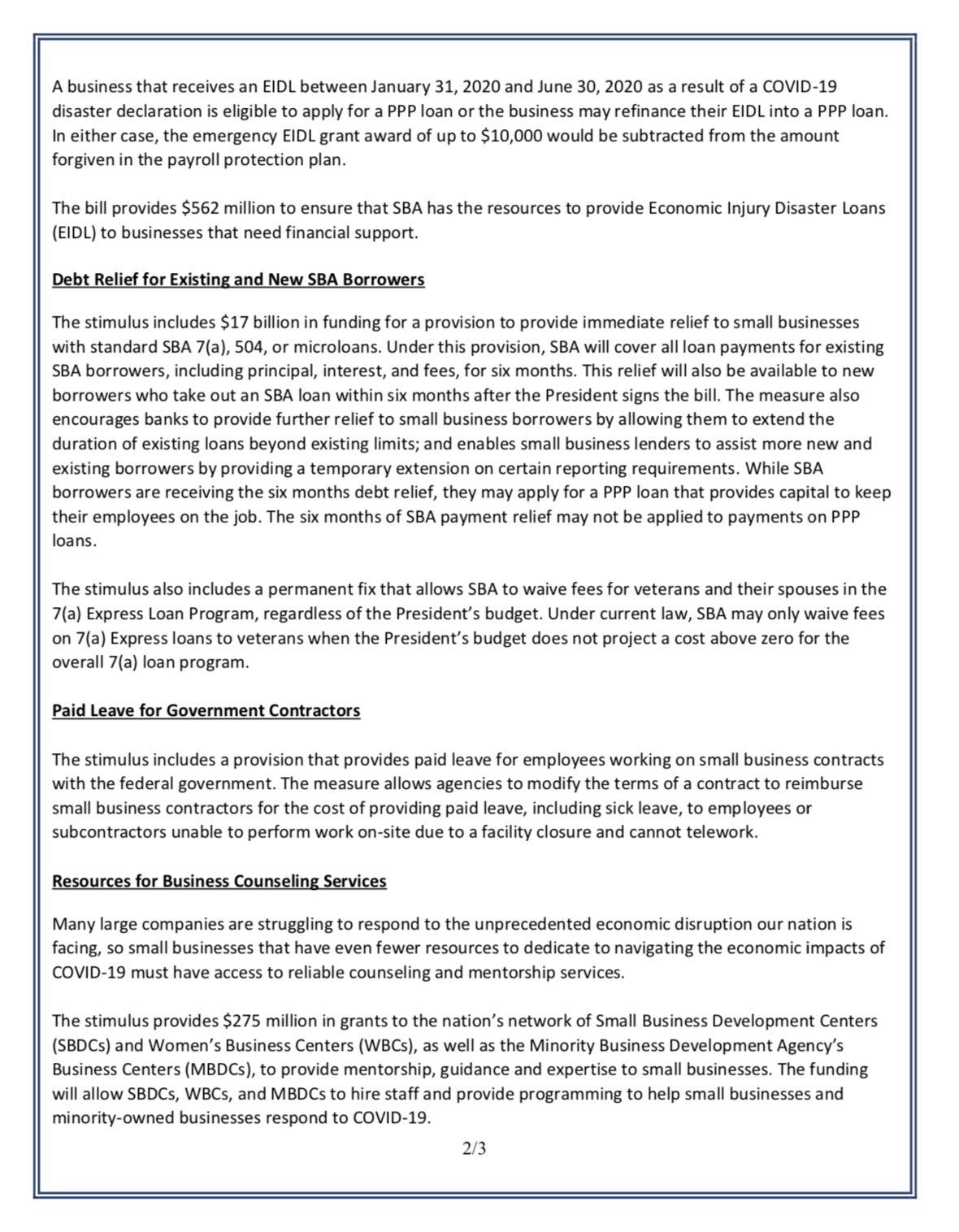

Sec. 1103: Entrepreneurial Development

Authorizes SBA to provide additional financial awards to resource partners (Small Business Development Centers and Women’s Business Centers) to provide counseling, training, and education on SBA resources and business resiliency to small business owners affected by COVID-19. Authorizes SBA to provide an association or association representing resource partners with grants to establish:

• one online platform that consolidates resources and information available across multiple Federal agencies for small business concerns related to COVID–19; and

• a training program to educate Small Business Development Center, Women’s Business Center, Service Corps of Retired Executives, and Veteran’s Business Outreach Center counselors on the various federal resources available to ensure counselors are directing small businesses appropriately.

Sec. 1104: State Trade Expansion Program

Supports small business trade and exporting by allowing states to carry over STEP funds from FY18 and FY19 into FY21 to ensure that they still have access to that money once normal business resumes. Directs the Administrator to reimburse STEP recipients for financial losses related to the cancelation of a foreign trade mission or trade show exhibition due to COVID-19, provided that the reimbursement is not greater than the recipient’s grant funding.

Sec. 1105: Waiver of Matching Funds Requirement under the Women’s Business Center Program

Eliminates the non-federal match requirement for Women’s Business Centers (WBC) for a period of three months.

Sec. 1106: Loan Forgiveness

Establishes that the borrower shall be eligible for loan forgiveness equal to the amount spent by the borrower during an 8-week period after the origination date of the loan on payroll costs, interest payment on any mortgage that was in force prior to February 15, 2020, payment of rent on any lease that was in force prior to February 15, 2020, and payment on any utility for which service began before February 15, 2020. Amounts forgiven may not exceed the principal amount of the loan. Eligible payroll costs do not include compensation above $100,000 in wages. Forgiveness on a covered loan is equal to the sum of the payroll costs incurred and payments made on a covered mortgage obligation (not including prepayment or payment of principal), a covered rent obligation, or covered utilities during the covered 8 week period, proportionate to maintaining employees and wages. Any loan amount not forgiven is carried forward as an ongoing loan with a maximum term of 10 years, at a maximum interest rate of four percent. The amount forgiven will be reduced proportionally by any reduction in employees or reduction in salaries. To encourage employers to rehire employees who have already been laid off due to the COVID--19 crisis, borrowers will not be penalized for having a reduced payroll at the beginning of the period so long as the employer eliminates the reduction in the number of employees and/or salary levels by June 30, 2020. Allows forgiveness for additional wages paid to tipped workers. Borrowers will verify to lenders their payments during the period, with documentation such payroll tax filings and proof of lease payments. Lenders that receive the required documentation will not be subject to an enforcement action or penalties by the Administrator relating to loan forgiveness for eligible uses. Upon a lender’s report of an expected loan forgiveness amount for a loan or pool of loans, the SBA will purchase such amount of the loan from the lender. Canceled indebtedness resulting from this section will not be included in the borrower’s taxable income.

Sec. 1107: Direct Appropriations

This section appropriates funds for the following uses:

• $349 billion for loan guarantees

• $675 million for Small Business Administration salaries and expenses

• $25 million for the Office of Inspector General

• $240 million for small business development centers and women’s business centers for

technical assistance for businesses

• $25 million for resource partner associations to provide online information and training

• $10 million for minority business centers for technical assistance for businesses

• $10 billion for emergency EIDL grants

• $17 billion for loan subsidies

• $25 million for Department of Treasury salaries and expenses

The cap for guarantees of trust certificates is set at $100 billion in principal for secondary market guarantee sales. Mandates a report from SBA within 180 days to the Committees on Appropriations in the House and Senate with a detailed expenditure plan for using the appropriated amounts.

Sec. 1108: Minority Business Development Agency

Authorizes $10 million for the Minority Business Development Agency within the Department of Commerce to provide grants to Minority Business Centers and Minority Chambers of Commerce for the purpose of providing counseling, training, and education on federal resources and business response to COVID-19 for small businesses. Eliminates the Minority Business Center program’s non-federal match requirement for a period of three months and allows for centers to waive fee-for-service requirements through September 2021. Mandates a report within 6 months from MBDA on the grant program.

Sec. 1109: United States Treasury Program Management Authority

Establishes the authority of the U.S. Department of Treasury, the Farm Credit Administration, and other federal financial regulatory agencies to authorize bank and nonbank lenders to participate, including insured credit unions in loans made under the Paycheck Protection Program. For financial institutions admitted under this section, gives Treasury the authority to issue regulations and guidance for terms concerning lender compensation, underwriting standards, interest rates, and maturity. Interest rates set under this authority may not exceed the maximum permissible rate of interest set on loans made under Section 1102 of this Act. Requires that Treasury ensure that terms and conditions provided by this section are the same as the terms established for loans under Section 1102 of this Act for borrower eligibility, maximum loan amount, allowable uses, fee waivers, deferment, guarantee percentage (to the maximum practicable extent), and loan forgiveness (to the maximum practicable extent). Allows Treasury to issue regulations and guidance as necessary, including to allow additional lenders to originate loans and establish terms. Prohibits borrowers from applying for this loan if that borrower has a previously pending application for a PPP loan or has already received a PPP loan. Establishes that the SBA will administer the program, including purchasing and guaranteeing loans, with guidance from Treasury. All 7(a) lenders can opt-in to participate in the Paycheck Protection Program administered by Treasury.

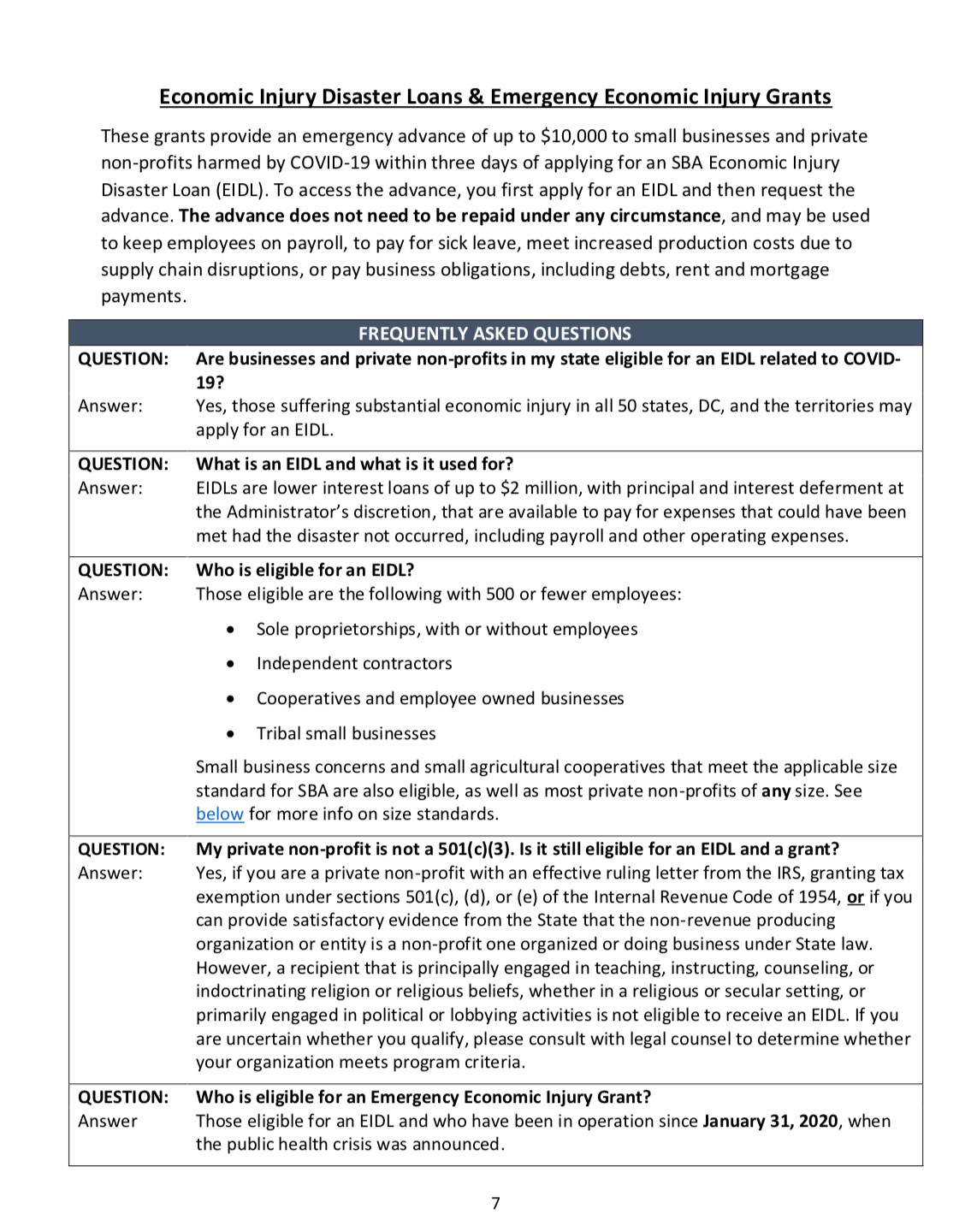

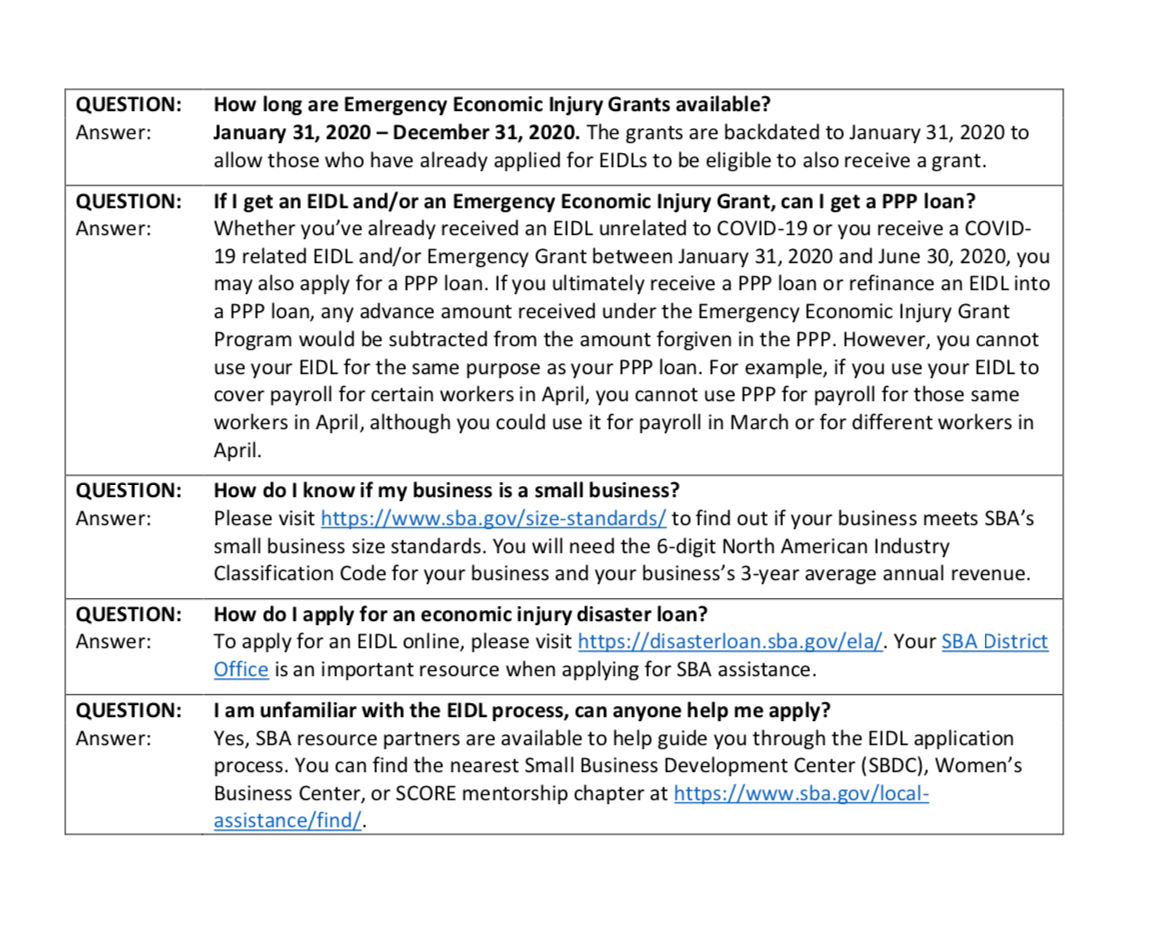

Sec. 1110: Emergency EIDL Grants

Expands eligibility for access to Economic Injury Disaster Loans (EIDL) to include Tribal businesses, cooperatives, and ESOPs with fewer than 500 employees or any individual operating as a sole proprietor, with or without employees, or an independent contractor during the covered period (January 31, 2020 to December 31, 2020). Private non-profits are also eligible for both grants and EIDLs. Requires that for any SBA EIDL loans made in response to COVID-19 before December 31, 2020, SBA shall waive any personal guarantee on loans below $200,000, the requirement that an applicant needs to have been in business for the 1-year period before the disaster, and the credit elsewhere requirement. During the covered period, allows SBA to approve and offer EIDL loans based solely on an applicant’s credit score, or use an alternative appropriate method for determining an applicant’s ability to repay. Establishes an Emergency Grant to allow an eligible entity who has applied for an EIDL loan in response to COVID-19 since January 31, 2020 to request an advance on that loan, of not more than $10,000, which the SBA must distribute within 3 days. Outlines that the emergency grant may be used for providing paid sick leave to employees, maintaining payroll, meeting increased costs to obtain materials, making rent or mortgage payments, and repaying obligations that cannot be met due to revenue losses. Establishes that applicants shall not be required to repay advance payments, even if subsequently denied for an EIDL loan. In advance of disbursing the advance payment, the SBA must verify that the entity is an eligible applicant for an EIDL loan. This approval shall take the form of a certification under penalty of perjury by the applicant that they are eligible. Requires that the emergency grant be considered when determining loan forgiveness, if the applicant refinances into a Paycheck Protection Program loan. Terminates the authority to carry out Emergency EIDL Grants on December 30, 2020. Establishes that an emergency involving Federal primary responsibility determined to exist by the President under Section 501(b) of the Stafford Disaster Relief and Emergency Assistance Act qualifies as a new trigger for EIDL loans and, in such circumstances, the SBA Administrator shall deem that each State or subdivision has sufficient economic damage to small business concerns to qualify for assistance under this paragraph and the Administrator shall accept applications for such assistance immediately. Adds “emergency” explicitly into other existing EIDL trigger language under Section 7(b)(2) of the Small Business Act.

Sec. 1111: Resources and Services Languages other than English

Authorizes $25 million for the SBA to offer resources and services in the ten most commonly spoken languages, other than English.

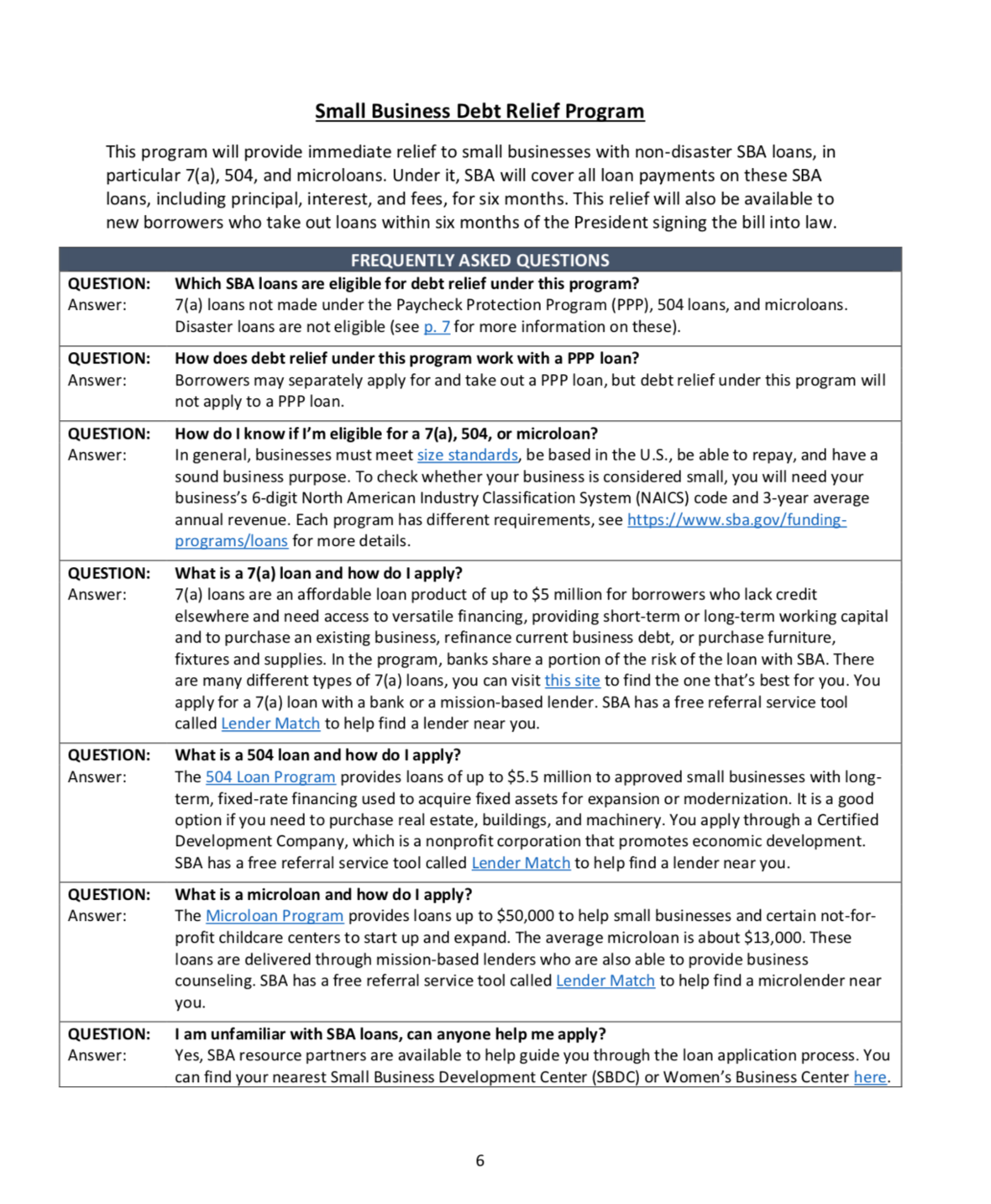

Sec. 1112: Subsidy for Certain Loan Payments

Defines a covered loan as an existing 7(a) (including Community Advantage), 504, or microloan product. A covered loan is also a 7(a) (including Community Advantage), 504, or microloan product that is issued within six months after enactment. Paycheck Protection Program (PPP) loans are not covered. Requires the SBA to pay the principal, interest, and any associated fees that are owed on the covered loans for a six month period starting on the next payment due. Loans that are already on deferment will receive six months of payment by the SBA beginning with the first payment after the deferral period. Loans made up until six months after enactment will also receive a full 6 months of loan payments by the SBA. SBA must make payments no later than 30 days after the date on which the first payment is due. Requires the SBA to still make payments even if the loan was sold on the secondary market. Requires SBA to encourage lenders to provide deferments and allows lenders, up until one year after enactment, to extend the maturity of SBA loans in deferment beyond existing statutory limits. Allows the SBA to extend lender site visit requirements due to higher volumes, travel restrictions, or the inability to access some properties during the COVID–19 pandemic.

Sec. 1113: Bankruptcy

Amends the Small Business Reorganization Act to increase the eligibility threshold to file under subchapter V of chapter 11 of the U.S. Bankruptcy Code to businesses with less than $7,500,000 of debt. The increase sunsets after one year and the eligibility threshold returns to $2,725,625. Amends the definition of income in the Bankruptcy Code for chapters 7 and 13 to exclude coronavirus-related payments from the federal government from being treated as “income” for purposes of filing bankruptcy. Sunsets after one year. Clarifies that the calculation of disposable income for purposes of confirming a chapter 13 plan shall not include coronavirus-related payments. Sunsets after one year. Explicitly permits individuals and families currently in chapter 13 to seek payment plan modifications if they are experiencing a material financial hardship due to the coronavirus pandemic, including extending their payments for up to seven years after their initial plan payment was due. Sunsets after one year.

Sec. 1114: Emergency Rulemaking Authority

SBA is required to establish regulations no later than 15 days after enactment of this title.

The NJEDA Small Business Emergency Assistance Grant Program is no longer available for small businesses. The response was so overwhelming that the program met its budget within the first 2 hours of rolling out the program. When more money becomes available, NJEDA will look at reintroducing this program.

The NJEDA has a long history of supporting growth in New Jersey for businesses of all sizes, but support of small to mid-sized businesses has always been one of our top priorities. With the creative and versatile loan solutions available to small to mid-sized businesses through the NJEDA, now is an opportune time to contact NJEDA to determine if any of our programs may be the right fit for your small to mid-sized business needs.

Access

Access is a pilot lending program that provides financing to small businesses in New Jersey - either in the form of direct loans through EDA, or through loan participations or guarantees in partnership with an EDA Premier Lender.

Access is different from other EDA financing programs in that it provides greater flexibility to borrowers by placing greater emphasis on the borrower's cash flow and less emphasis on hard collateral.

Learn more > https://www.njeda.com/financing_incentives/small_midsize_business/Access

Micro Business Loan Program

The Micro Business Loan Program makes financing of up to $50,000 available to for-profit businesses legally registered to do business in New Jersey, with a business location in New Jersey (home-based businesses are not eligible), who have annual revenues in the most current fiscal year of no more than $1,500,000, and 10 full-time employees or less at time of application.

Startup businesses are eligible for financing but must demonstrate to the Authority that they have completed an entrepreneurship training program or Small Business Development Center counseling sessions.

Learn more > https://www.njeda.com/financing_incentives/small_midsize_business/Microbusiness-Loan-Program

Premier Lender Program

The Premier Lender Program creates new opportunities for small businesses and EDA’s lending partners by providing new, low-cost financing opportunities with faster turnaround.

If your small business is discussing potential financing with one of EDA’s Premier Lender banks, EDA’s participation or guarantee of a portion of the financing can lower the cost of borrowing for your business.

Learn more > https://www.njeda.com/financing_incentives/programs/Premier-Lender-Program

Direct Loans

New Jersey businesses in need of financing and committed to job creation/retention may be eligible for direct loans through EDA when financing is not available under other EDA financing programs.

Learn more > https://www.njeda.com/financing_incentives/programs/direct_loans

CDFI Loan to Lender Program

Through the CDFI Loan to Lender Program, NJEDA provides financing to qualified Community Development Financial Institutions (CDFIs), for the purposes of administering term loans or lines of credit to qualified micro-enterprises and small businesses, some of which may not be able to secure traditional bank financing.

Learn more > https://www.njeda.com/financing_incentives/small_midsize_business/CDFI-Loan-to-Lender-Program

Premier CDFI Program

Through the Premier CDFI Program, NJEDA can provide small businesses with loan participations, loan guarantees, and line of credit guarantees in partnership with designated Premier Community Development Financial Institutions (CDFIs).

Learn more > https://www.njeda.com/financing_incentives/small_midsize_business/Premier-CDFI-Program

Small Business Bonding Readiness Assistance Program

New Jersey Economic Development Authority (NJEDA) has partnered with The African American Chamber of Commerce of New Jersey (AACCNJ) for the Small Business Bonding Readiness Assistance Program. The program is designed to help construction business needs, providing comprehensive technical assistance, supportive services and access to capital.

Learn more > https://www.aaccnj.com/bonding-program---sbbrap.html

Small Business Fund

Creditworthy small, minority-owned or women-owned businesses in New Jersey that have been in operation for at least one full year and may not have the ability to get bank financing, or not-for-profit corporations that have been operating for at least three full years, may be eligible for direct loans under the Small Business Fund.

Learn more > https://www.njeda.com/financing_incentives/programs/small_business_fund

Small Business Lease Assistance Program

The Small Business Lease Assistance Program offers reimbursement of a percentage of annual lease payments to for profit businesses and non-profit organizations in eligible areas that plan to lease between 500 – 5,000 s.f. of new or additional market-rate, first-floor office, industrial or retail space for a minimum 5-year term.

Learn more > https://www.njeda.com/financing_incentives/small_midsize_business/Garden-State-Growth-Zone-Business-Lease-Incentive

Small Business Services

In addition to the millions of dollars in funding EDA administers as loans and loan guarantees to New Jersey small businesses, EDA also partners with several organizations that provide a wide array of services to New Jersey small businesses and entrepreneurs.

Learn more > https://www.njeda.com/small_midsize_business/services

Wineries & Vineyards

Eligible New Jersey wineries and vineyards can now access financing through the NJEDA.

Learn more > https://www.njeda.com/financing_incentives/small_midsize_business/Wineries-and-Vineyards

Kind regards,

NJ State Veterans Chamber of Commerce