The Small Business Emergency Assistance Loan Program provides direct financing of up to $100,000 to New Jersey-based businesses and nonprofits that have been negatively impacted by the COVID-19 pandemic.

Pre-registration for the Small Business Emergency Assistance Loan Program (Phase 2) will be open from 9:00 a.m. on Tuesday, July 20th, 2021 through 5:00 p.m. on Friday, July 30th, 2021.

Any business interested in applying for this loan program must pre-register on the NJEDA’s application portal during the pre-registration period in order to be eligible to apply. Pre-registration is not first-come, first-served, so entities may pre-register at any time during the open pre-registration period.

-A physical commercial location in the State of New Jersey.

-In existence by the date of application launch.

-$10 million or less in annual revenue.

-Fully and properly registered to do business with New Jersey Department of Treasury, Division of Revenue and Enterprise Services.

-No tax debts due to the State.

-In good standing with the Department of Labor and Workforce Development, with all decisions of good standing at the discretion of the Commissioner of the Department of Labor and Workforce Development.

Businesses that meet these baseline eligibility requirements will be sorted into Stage 1 and Stage 2 applicants.

-Stage 1 applicants must have acquired at least 500 square feet of additional space by executing a new lease, leasing additional space, or acquiring an owner-occupied commercial space on or after January 1st, 2021.

-Stage 2 applicants are those that do not meet the new lease, additional leased space or acquired owner-occupied commercial space criteria. Stage 2 applicants that meet the baseline eligibility requirements above ARE eligible for financing.

-Home-based businesses. A home-based business is a business operated out of a residential property not zoned for commercial activity.

-Real estate holding companies.

-Businesses related to gambling or gaming activities.

-Businesses related to the purveyance of “adult” (i.e., pornographic, lewd, prurient, obscene) activities, services, products, or materials (including nude or semi-nude performances or the sale of sexual aids or devices).

-Auction or bankruptcy or fire or “lost-our-lease” or “going-out-of-business” or similar sales.

-Traveling merchants.

-Christmas tree sales or other outdoor storage.

-Any other activity constituting a nuisance.

-Businesses that are illegal under the laws of the State of New Jersey.

The State has allocated a total of $10 million for the Small Business Emergency Assistance Loan Program (Phase 2). In line with Governor Murphy’s commitment to building a stronger, fairer New Jersey, $3.5 million will be reserved for entities located in one of the 715 census tracts that were eligible to be designated as an Opportunity Zone.

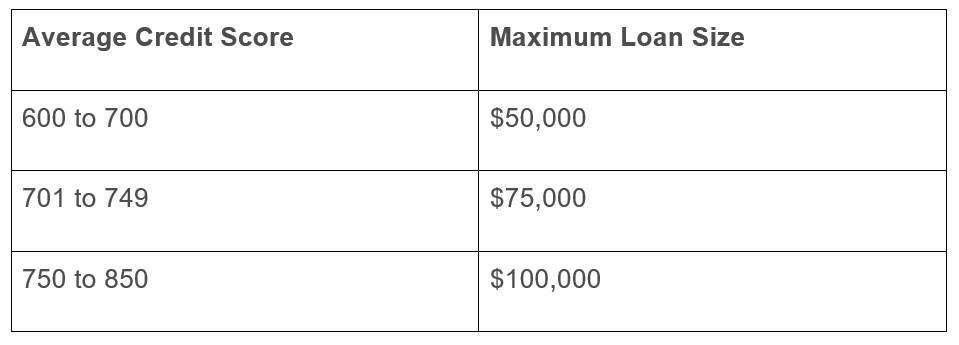

For for-profit entities, the maximum amount a business is eligible to receive will be based on the owners’ average credit scores. Once this cap is determined, the amount the entity is approved for will be based on validation of support provided for the uses requested (i.e. if a business applies for and is eligible for $100,000 based on credit score, but the documentation provided only supports $85,000 –the request will be reduced to $85,000).

The majority business owner will be required to have an average minimum credit score (FICO) of 600 to be eligible for funding. When there are multiple owners with equal ownership, NJEDA will review the lowest average credit score of all owners and will use the lowest average credit score to determine the amount of funding available. In cases where the lowest average score is below 600, the applicant entity would be eligible for up to $50,000, provided at least one other majority owner has an average credit score above 600.

Below is a chart that estimates your loan size based on credit score:

_files/60e5ec08d2c0dd2ae2fe5b03_Small Business Emergency Assistance Loan-Phase2.jpg)

Loan amounts to non-profit entities will be based only on validation of support provided for the uses requested, but they must also meet a minimum Debt Service Coverage Ratio (DSCR) of 1.00x based on the entity’s most recent tax return or financial statement.

*Financing can only be used for expenses incurred on or after August 3rd, 2021.

-Inventory

-Rent/Mortgage

-Payroll

-Utilities

-Personal protective equipment

-Furniture, fixtures, or equipment that do not require professional installation costs in excess of $1,999.00

-Operating expenses incurred prior to August 3rd, 2021

-Refinancing of existing debt

-Personal, non-business obligations or costs incurred by related entities

-Construction-related expenses or contracts

-Furniture, fixtures or equipment requiring professional installation costs in excess of $1,999.00

The Small Business Emergency Assistance Loan Program (Phase 2) is structured specifically for entities facing economic challenges due to the COVID-19 pandemic. Financing received through the program is subject to flexible terms, including:

-10-year term and amortization

-0% interest rate

-Deferred repayments for 24 months

There are no fees associated with the Small Business Emergency Assistance Loan Program (Phase 2) for the first five years of the loan. After five years, the NJEDA’s standard modification fees will apply, if applicable.

If you have never applied for NJEDA financing before, visit the NJEDA application portal now to create a new username and password. Store this information so that you can easily locate it for when the pre-registration period opens.

If you have applied for financing and cannot remember your information, you will be able to reset your password through the portal.

If you have any difficulties creating or finding your username and password, please consult the first several slides of the Sample Pre-Registration document for clear instructions or call the NJEDA Call Center at 844-965-1125 for assistance.

PLEASE NOTE: Creating a username and password does not mean that you are pre-registered for the Phase 2 Loan Program. You will still need to complete a Phase 2 pre-registration form, which will be available from Tuesday, July 20th, 2021 through Friday, July 30th, 2021.

All businesses and nonprofits that would like to apply for financing through the Small Business Emergency Assistance Loan Program (Phase 2) must complete the pre-registration form on the NJEDA’s application portal. This form will only be available from 9:00 a.m. EST on Tuesday, July 20th, 2021 through 5:00 p.m. EST on Friday, July 30th, 2021.

Pre-registration is not first-come, first-served, but it is strongly encouraged that applicants start the form as early as possible.

On the pre-registration form, entities should be prepared to provide the following information:

-Contact information for someone who is authorized to speak on behalf of the entity, such as an owner or an executive such as a CEO or Executive Director.

-Full name of the registered legal entity.

-Ownership structure (sole proprietorship, LLC, Non-Profit Organization, etc.).

-9-digit Employer Identification Number (EIN; Federal Tax ID Number).

-Date the entity was legally formed.

-Annual revenue based on most recent business tax filing.

-Total amount of other Federal, State, or county/municipal COVID-19 relief funding applied for and received.

-Lease information about any new or additional space leased after January 1st, 2021, if applicable.

-Loan amount the business is requesting from the NJEDA (cannot exceed $100,000).

Click here to see a sample pre-registration form.

Qualified businesses and nonprofits that submit a completed pre-registration will be able to apply for financing through the Small Business Emergency Assistance Loan Program (Phase 2) in stages.

-Stage 1 entities will have an exclusive 10-day window to apply for the program, beginning at 9:00 a.m. on Tuesday, August 3rd, 2021.

-Stage 2 entities will be able to apply beginning at 3:00 p.m. on Friday, August 13th, 2021.

Generally speaking, applications will be reviewed on a first-come, first-served basis, based on the date and time the NJEDA receives an entity’s completed application form.

When you apply for the loan, please be prepared to p0rovide the following information about your entity and entity’s ownership:

-Names, personal addresses, dates of birth, and social security numbers of any individuals or entities with ownership of the applicant entity.

-Information on how the entity intends to use the loan. If you are using the loan for furniture/fixtures/equipment or personal protective equipment, you will need to know whether those items require professional installation and the estimated cost to professionally install them, if applicable.

-Information on other Federal, State, or county/municipal assistance the entity has applied for and/or received. This may include but is not limited to, PPP, SBA EIDL, NJRA grants, and NJEDA grants or loans. For each item you list, you will need to know: Was your entity approved, declined or is it still under review? What was the amount your entity applied for and/or received? If approved, what is the funding being used for?

-Answers to the State’s basic debarment questionnaire. This includes being able to affirmatively certify that: the applicant entity is not a home-based business; the applicant entity is not a prohibited business; the applicant entity has been impacted by the COVID-19 pandemic; the applicant entity will make a best effort not to lay off any additional employees and to re-hire any whom you have already laid off; the information you are providing in the application is correct; you will allow the NJEDA to check your entries against other State sources of data; you will authorize NJEDA to obtain a credit report on all guarantors; you are current on all state obligations.

Once the NJEDA receives your completed application form, staff will conduct a preliminary review to determine if your entity is eligible. All applicants will receive a communication from the NJEDA, even if the Authority does not move forward with your application.

If your entity is determined to be eligible, you will receive an email from the NJEDA with instructions to provide additional financial information about your entity. Once you receive this notification from the NJEDA, you will need to log back into the application portal to upload the required financial information. You will have 5 days from the date/time the NJEDA sends the request to upload the required information.

In order to be as prepared as possible to provide the documentation the NJEDA needs, please see the Document Upload Checklist.

If the NJEDA offers your entity a loan, you will be asked to provide following as part of the closing process:

-Evidence of proper business insurance coverage.

-Copies of a government issued photo identification document for all individuals who may become party to the loan.

-ACH details to enable transmission of proceeds.

-Frequently Asked Questions

-Sample Pre-Registration

-Document Upload Checklist

Source: NJEDA