The Micro Business Loan Program application is expected to be available in the coming days. Please continue to check the NJEDA website and this page for any updates.

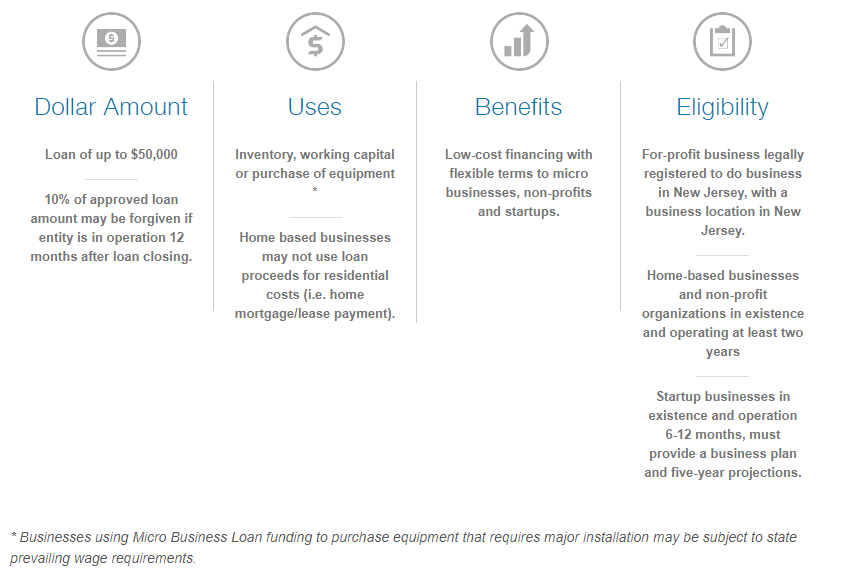

The Micro Business Loan Program makes financing of up to $50,000 available to businesses with annual revenues in the most current fiscal year of no greater than $1,500,000, and 10 full-time employees or less at time of application. Financing can be used for inventory, the purchase of equipment, or working capital. Ten percent of the approved loan amount may be forgiven if the business is still open and in operation 12 months from date of loan closing.

Startup businesses (defined as being in operation 6-12 months) are eligible for financing but must provide the Authority a business plan and five-year projections at time of application.

-Must be one of the following:

-A for-profit business legally registered to do business in New Jersey, with a business location in New Jersey.

-A home-based business or not-for-profit organization in existence and operation for at least two years.

-A startup business, in existence and operation between 6-12 months, must provide a business plan and five-year projections.

-Must have annual revenues in most recent fiscal year of no greater than $1,500,000 (based on most recent tax return).

-At time of application, business cannot have more than 10 full-time employees in total. All employees must work in New Jersey.

-Entity must certify to make its best effort not to furlough or lay off any individuals through the end of the declared emergency and public health emergency related to COVID-19

-Entity will also be required to certify that no have tax debts due to the State, and must be in good standing with the New Jersey Department of Labor and Workforce Development.

-Must have minimum credit score of 600.

-Collateral Requirements:

-Loans of $25,000 or less will be unsecured (no collateral required)

-For loans of greater than $25,000, NJEDA will accept various forms of collateral for the full loan amount. EDA may look to place liens on any new equipment purchases including rolling stock, blanket lien on personal/business assets, residential or investment property to meet the collateral requirement. Maximum loan to value of 100% for secured loans

-Standard 10 year term, with the ability to increase to 15 years if needed in order to meet the 1.00x global debt service coverage ratio requirement.

-Interest Rate: 2 percent, set at approval, with no interest and no payment due for the first three years.

-10% of the total approved loan amount will be forgiven if the business is open and operating 12 months after closing date.

-No fees for entities that apply within the first three months the program is available.

-Following the three-month period, fee structure is as follows:

-Application fee: $300

-Commitment Fee: 0.5% of loan amount

-Closing Fee: 0.5% of the loan amount

The Micro Business Loan Program application is expected to be available in the coming days. Please check the NJEDA website and this page for any updates.

Potential applicants are encouraged to review the application checklist in preparation for applying for the program.

Please contact an NJEDA Small Business Services Team member below prior to applying for the Micro Business Loan Program.

To ask a specific question via email, please send an email to smallbusinessservices@njeda.com and a team member will reach out to you.