FOR IMMEDIATE RELEASE

April 14, 2020

Labor Department Implements Customer-Service, Tech Improvements to Address Historic Increase in Unemployment Claims

TRENTON – The New Jersey Department of Labor and Workforce Development (NJDOL) has made a series of moves – from upgrading computer technology to adding personnel and boosting phone capacity – to get unemployment claims processed faster and customers’ questions answered quicker.

The announcement comes as record numbers of unemployment claims continue to flood the New Jersey Labor Department, and labor departments across the country.

“I feel it in the pit of my stomach for every worker’s claim we haven’t gotten to yet,” said Labor Commissioner Robert Asaro-Angelo. “We are paying benefits to nearly 300,000 New Jerseyans, but that is of little consequence if your claim isn’t one of them. Our entire staff empathizes with your frustration and uncertainty. That’s why we have been working around the clock to find solutions to common problems weighing on the system.”

Here is a list of the measures that have been, or are about to be, implemented to improve customer service at the Department:

-The first batch of supplemental unemployment payments has processed and distributed, getting an extra $600 into claimants’ pockets just after the holidays. Some 258,062 unemployed residents are seeing this money in their accounts yesterday and today, for a total of $154.8 million in payouts.

-Some 166,000 residents -- more than 60% of those waiting for an agent to review their unemployment application -have had their claim processed, thanks to updated IT programming. This enabled these applicants to receive a quick determination of their eligibility. Going forward, this same percentage of claims formerly requiring an agent review will be entered directly into the system as a result of this significant upgrade.

-Hundreds of laptops have been delivered and configured and hundreds more are arriving this week, allowing additional claims agents and support staff to work from home, which will speed processing time for claims requiring agent review, and allow more staff to triage customer questions.

-A document explaining the benefits process for independent contractors and freelancers will be posted on our website today, guiding this group through the process to collect their Pandemic Unemployment Assistance payments as soon as possible. This will reduce a significant volume of phone and email inquiries.

-An intelligent automated reply to emails has been deployed so that whenever someone sends an email, they receive a reply specific to their inquiry directing them to the appropriate Labor’s FAQs, pin reset and solutions to other common questions. This will relieve stress for customers who have been waiting for an email reply and provide them with steps they can take on their own.

-The capacity of the call centers was expanded Wednesday to provide additional inquiry lines. Prior to this upgrade, tens of thousands of callers were met with dead air, or a dial tone, because the system was beyond its capacity. This is no longer happening. Additionally, more callers are able to provide their information over the phone.

-An automated pin reset function has been developed, which eliminates a common reason for applicant calls.

-The Appeal Tribunal has been set up to conduct virtual appeal hearings, alleviating delays for customers who were denied unemployment benefits and are appealing the decision.

“The unceasing efforts of our Division of Information Technology and Unemployment Insurance staff, coupled with the assistance of the Office of Information Technology staff, have enabled us to reconfigure our legacy computer systems to serve more customers than ever before,” said Asaro-Angelo. “They have been working nonstop since the pandemic struck New Jersey, and I want to thank them for their commitment to getting benefits to everyone who deserves them as quickly as possible.”

The number of jobless claims is far higher than New Jersey has ever experienced –576,904 New Jerseyans applied for unemployment in the three weeks starting March 15. After the first week of the pandemic, the number of new claims jumped more than 1,600 percent from the week before COVID-19 struck.

The number of new unemployment claims moving through the system without issue has increased, thanks to the updated programming. Claims are being backdated, so anyone who has had trouble getting through will not lose a week of benefits.

It’s important to note that workers cannot choose to collect unemployment benefits if employment is available. A worker who voluntarily quits a job is ineligible for unemployment.

For more information on benefits eligibility, customers are urged to visit nj.gov/labor or MyUnemployment.nj.gov.

###

Self-Employed NJ Workers:

FREQUENTLY ASKED QUESTIONS DURING THE CORONAVIRUS EMERGENCY

OVERVIEW: Assistance is available to self-employed workers, independent contractors, gig and platform workers who are impacted by COVID-19.

THE CORONAVIRUS AID, RELIEF, AND ECONOMIC SECURITY ACT: UNEMPLOYMENT INSURANCE RELIEF FOR WORKERS IMPACTED BY COVID-19 The federal Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on March 27, 2020. It provides assistance to workers who have been negatively impacted by the coronavirus emergency by creating Pandemic Unemployment Assistance (PUA). Please note: This document may be modified as more information becomes available.

1. I’m self-employed, an independent contractor, a gig worker, or a platform worker. What do I get from the CARES Act? If eligible, you can receive Pandemic Unemployment Assistance (PUA). These benefits can be retroactive for periods of unemployment that began after February 2, 2020.

2. How much is PUA? PUA potentially provides the same amount as regular unemployment (60% of your average weekly salary, up to a maximum of $713 per week) for up to a total of 39 weeks. The PUA amount for the self-employed is calculated using prior year(s) tax returns if wages are not reported through wage records. The PUA minimum, for businesses operating at a loss or with insufficient income to qualify for benefits, is $231 per week. PUA benefits are considered taxable income. PUA recipients are also eligible for an extra $600 per week, also taxable. The $600 per week is retroactive to the week ending April 4, 2020, and ends the week of July 25, 2020.

3. How can I get PUA? You must be negatively impacted by the coronavirus emergency to be eligible. See USDOL’s website, “Unemployment Insurance Relief During COVID-19 Outbreak.” You will have to certify that you are unemployed, partially unemployed, or unable or unavailable to work for any of a list of coronavirus-related reasons.

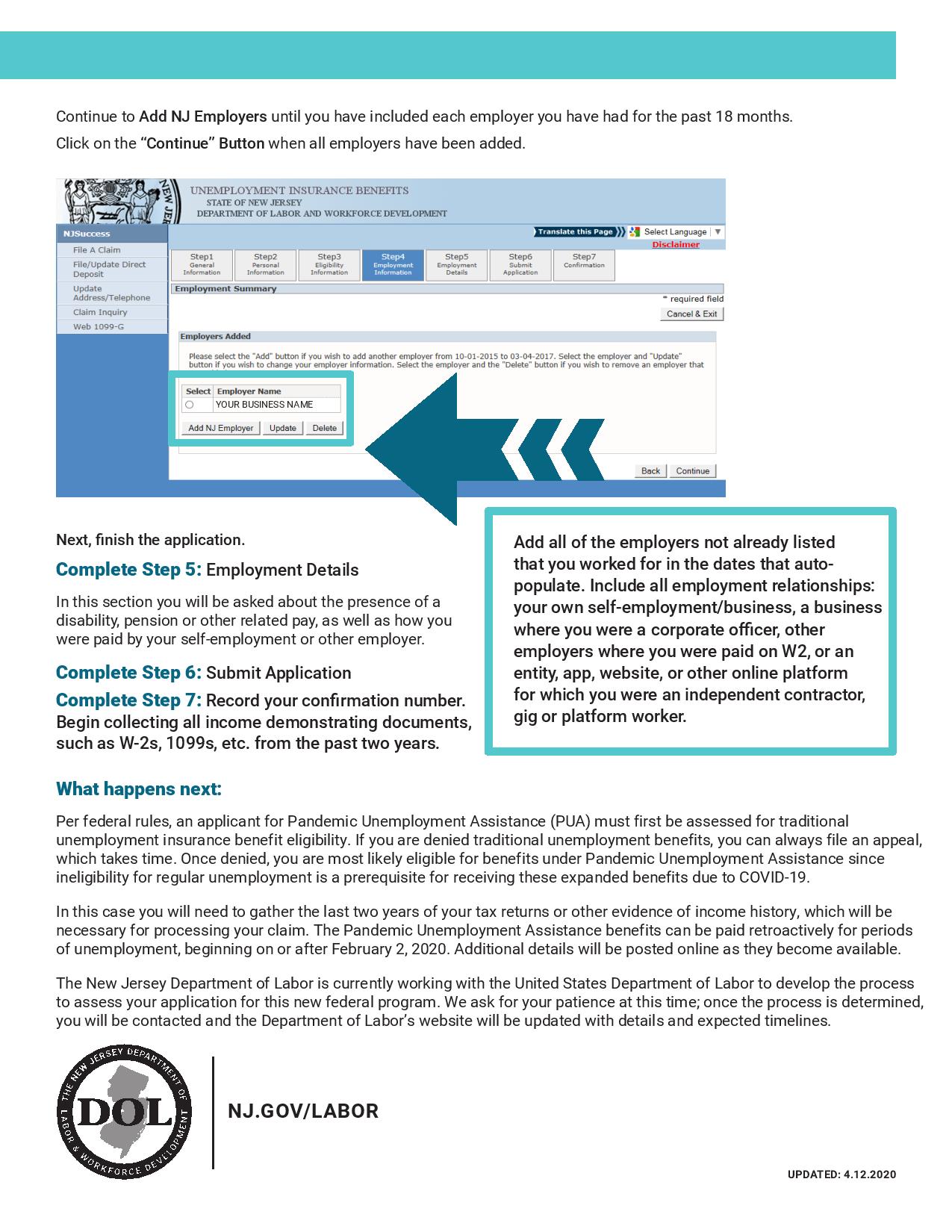

-NJDOL is working with the U.S. Department of Labor to develop the process to assess your application for this new federal program of Pandemic Unemployment Assistance. In the meantime, applying for unemployment insurance is the necessary first step.

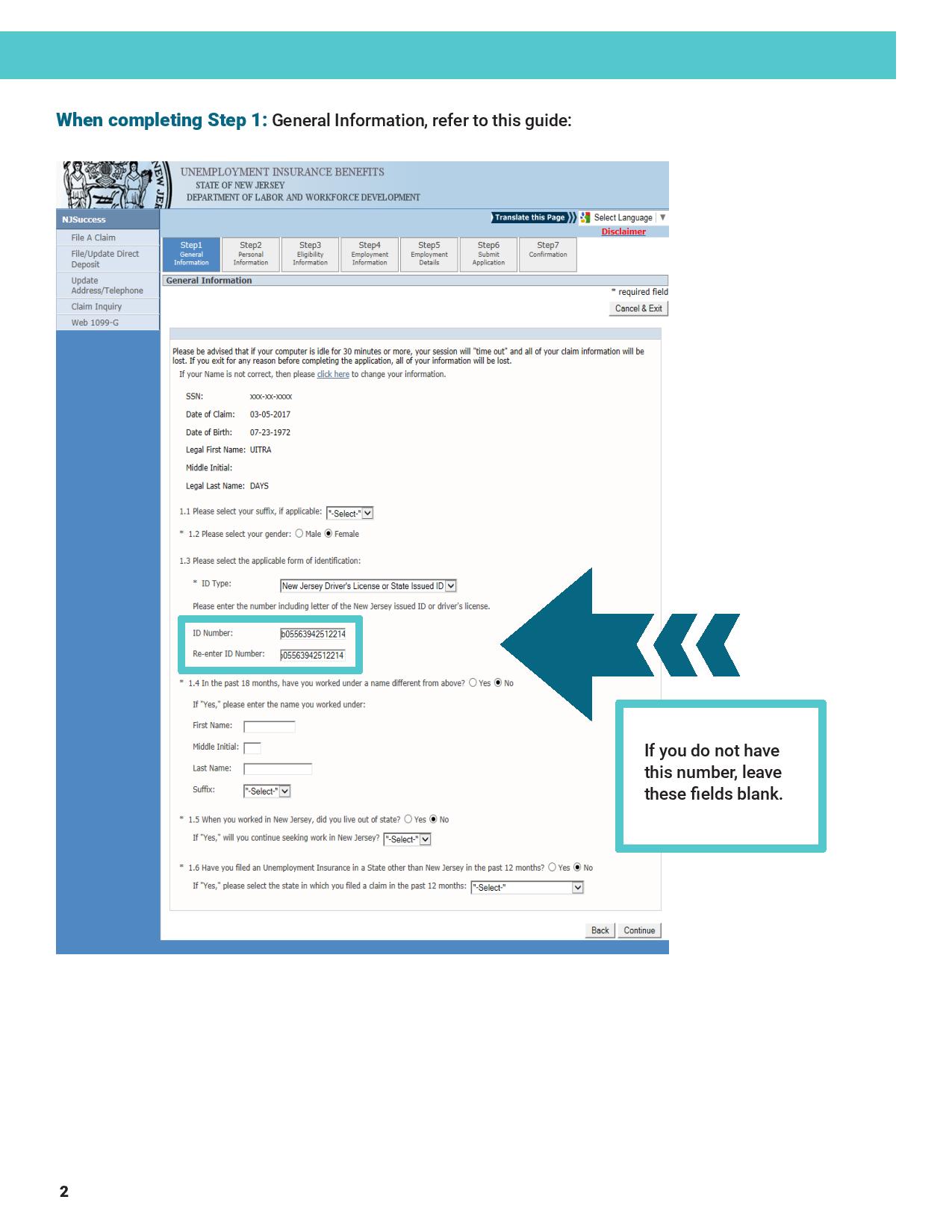

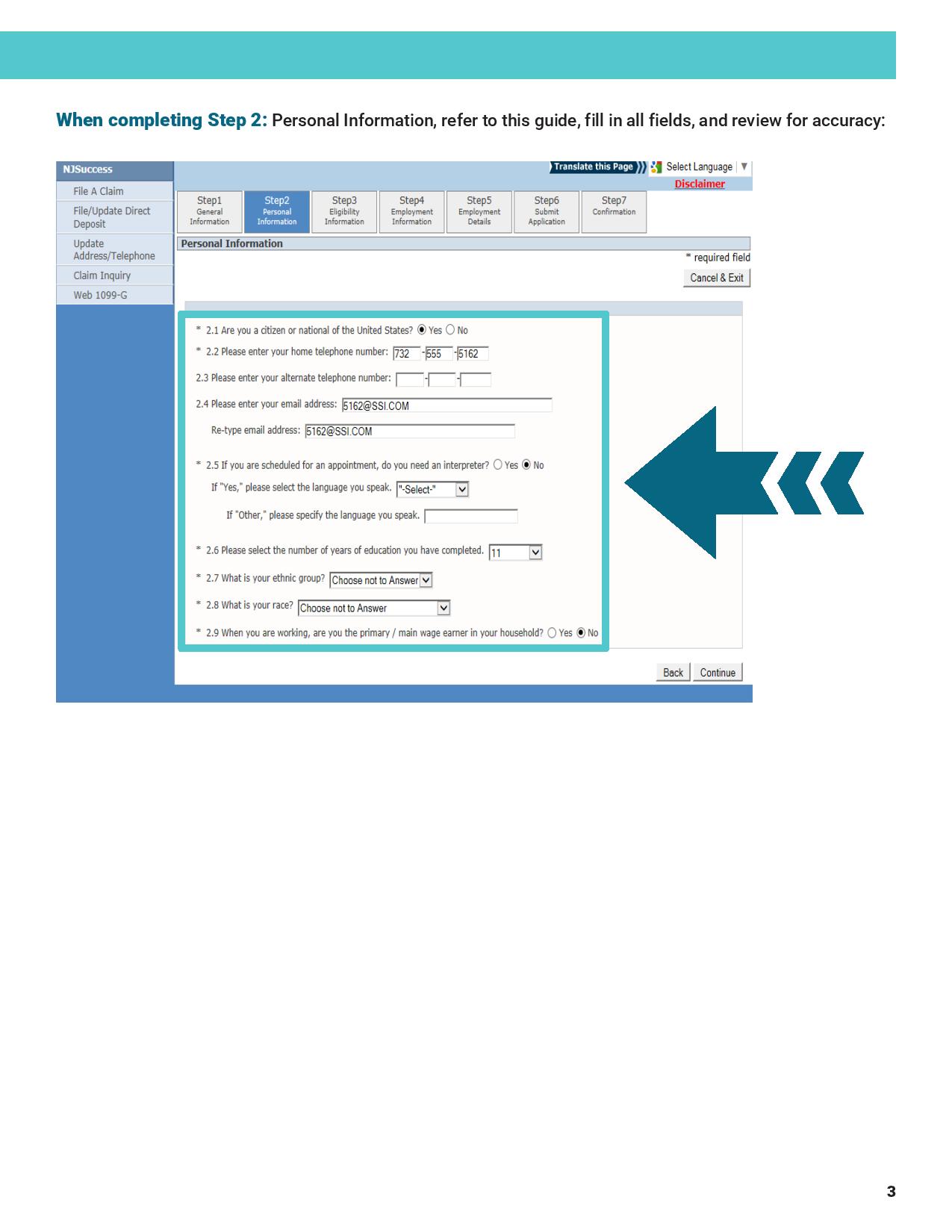

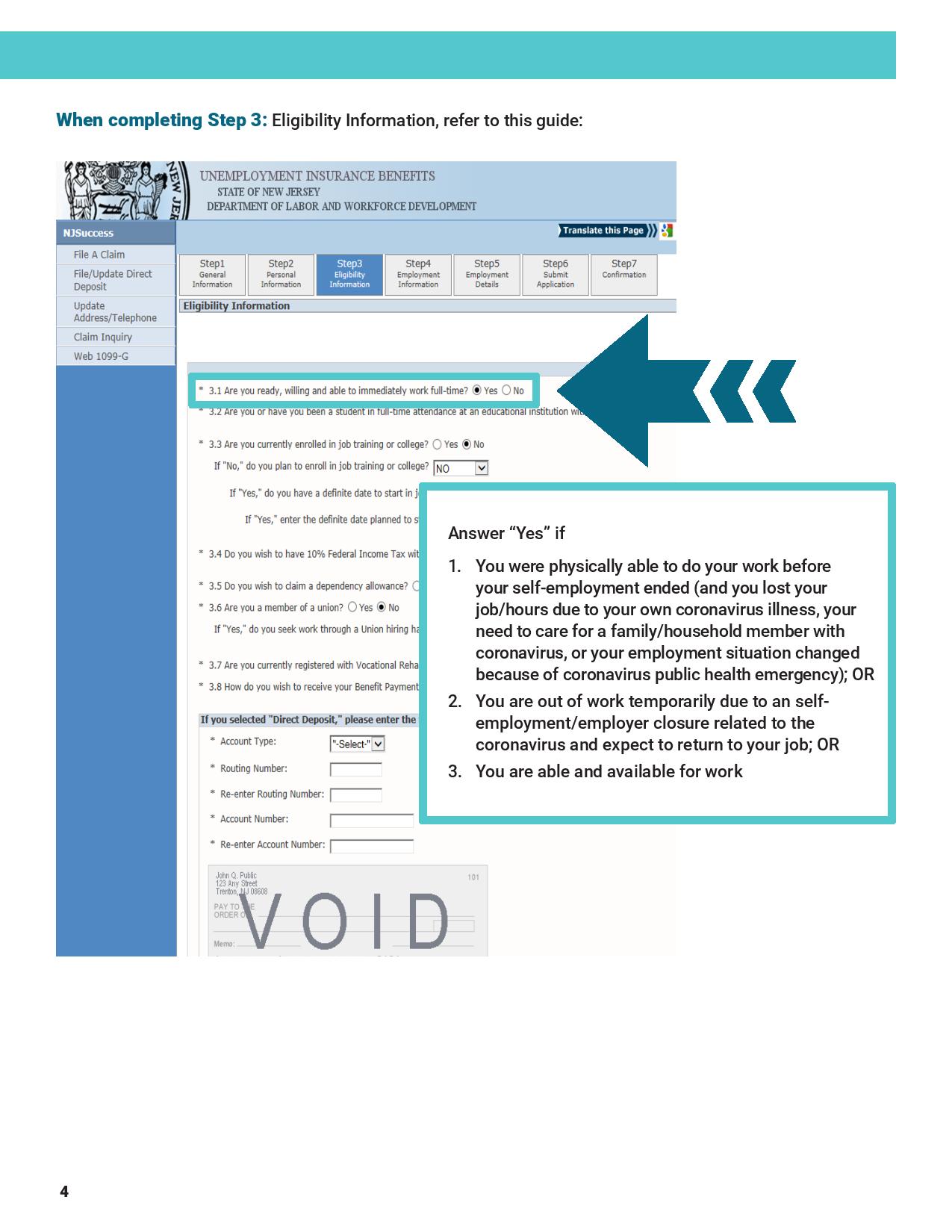

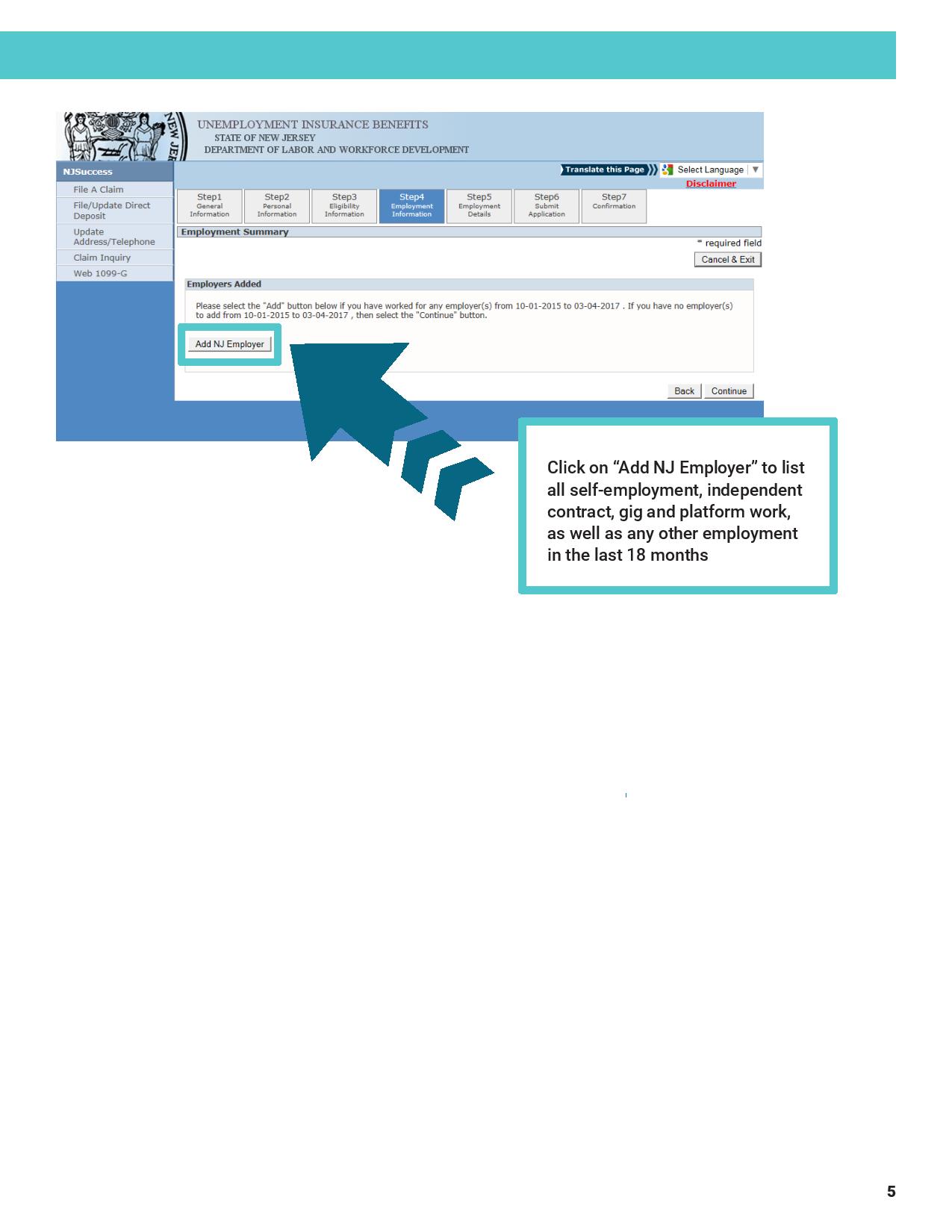

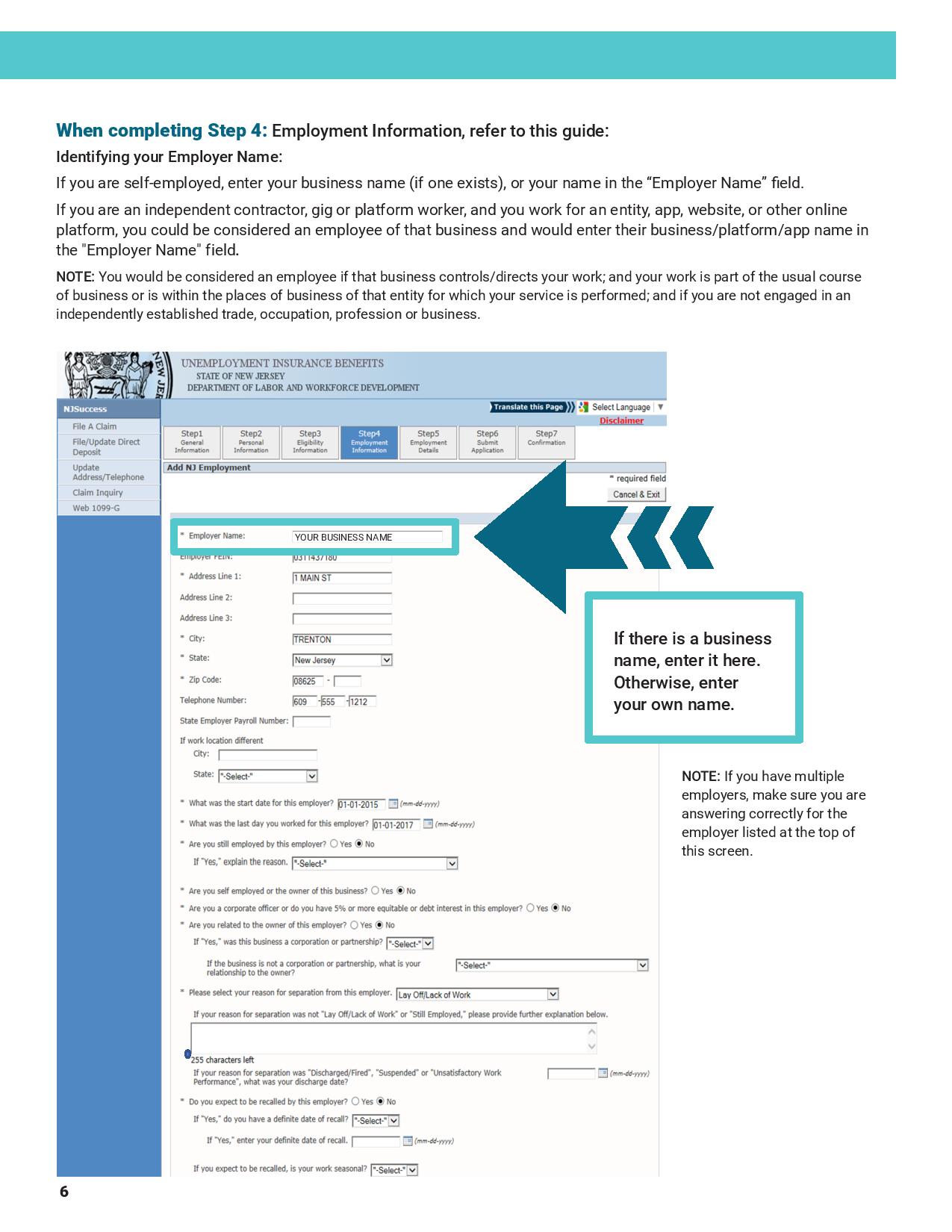

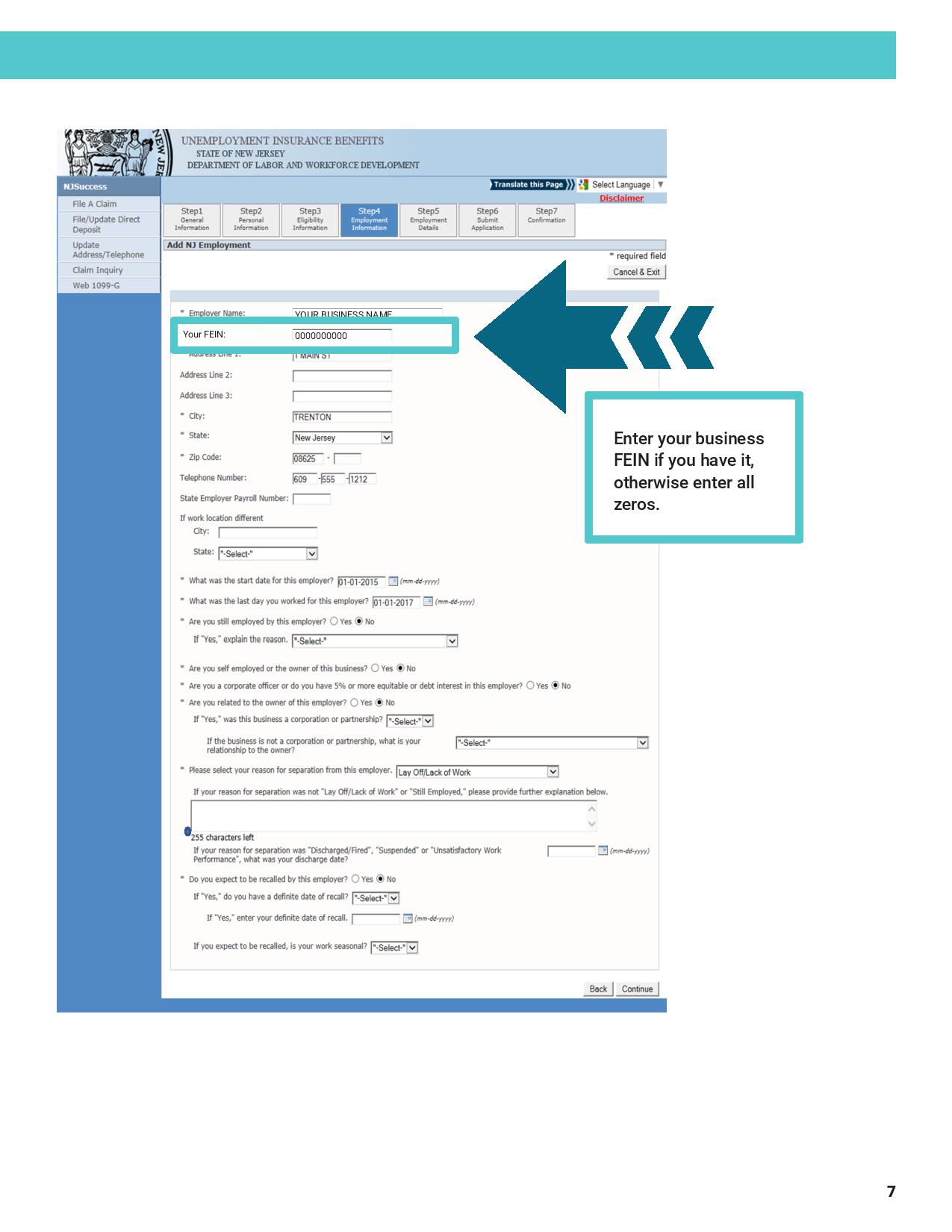

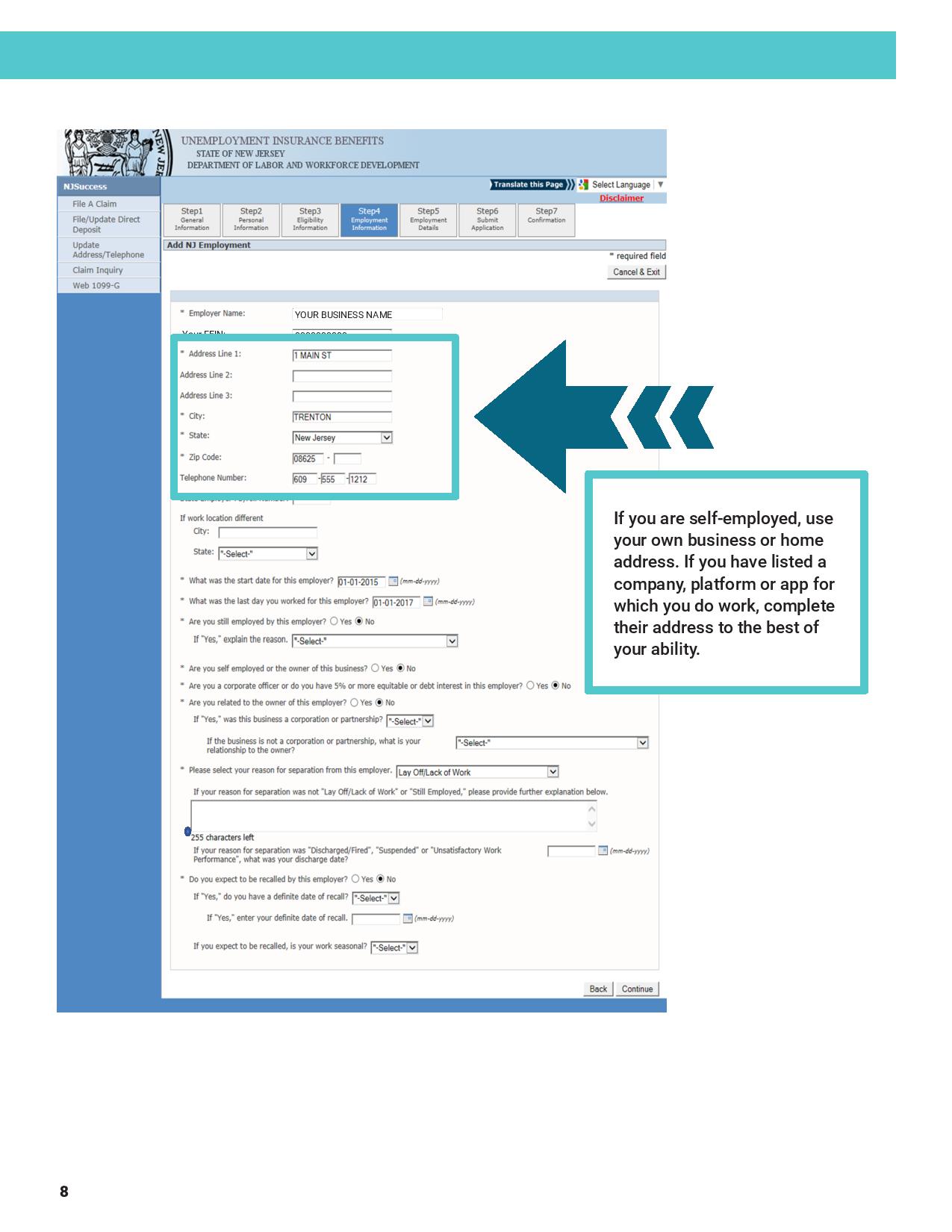

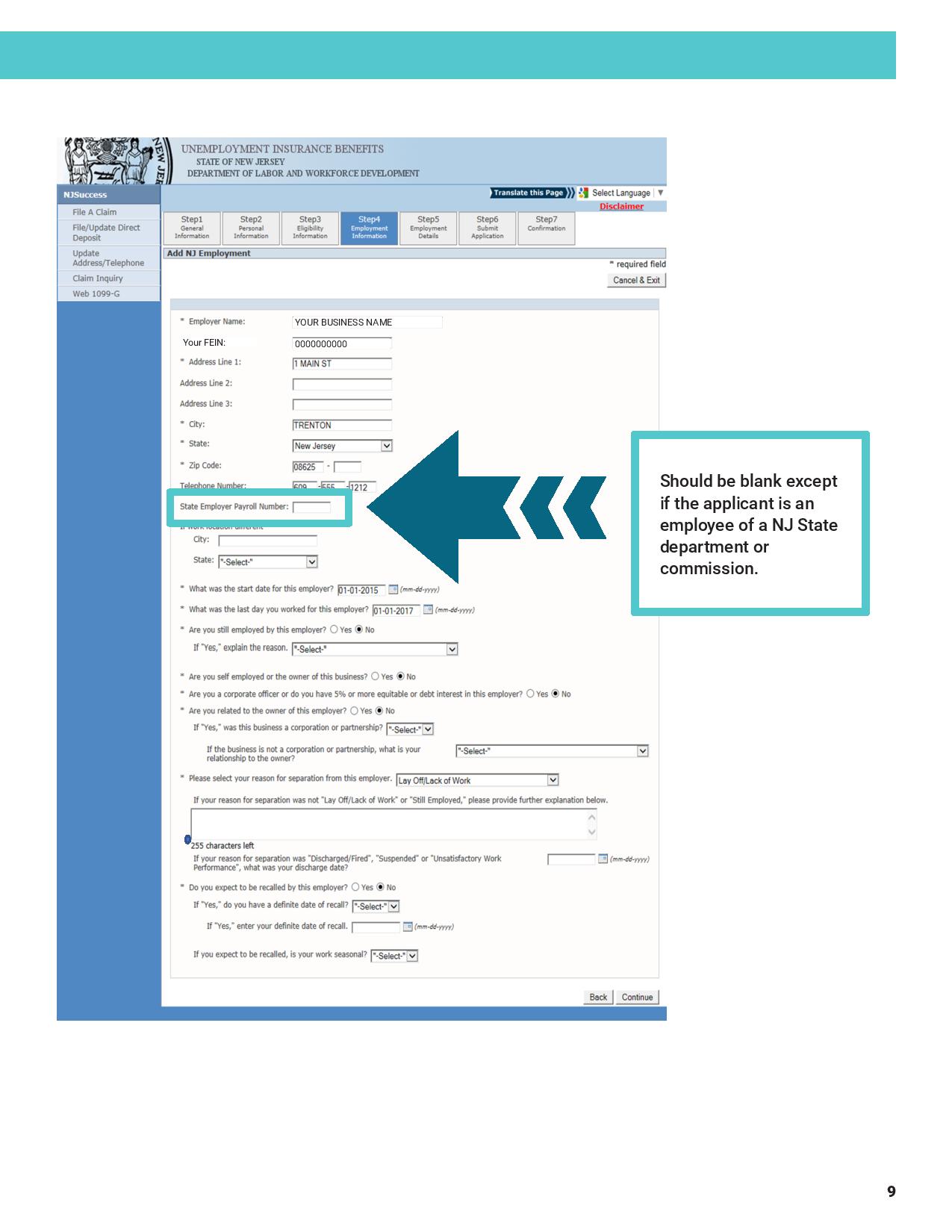

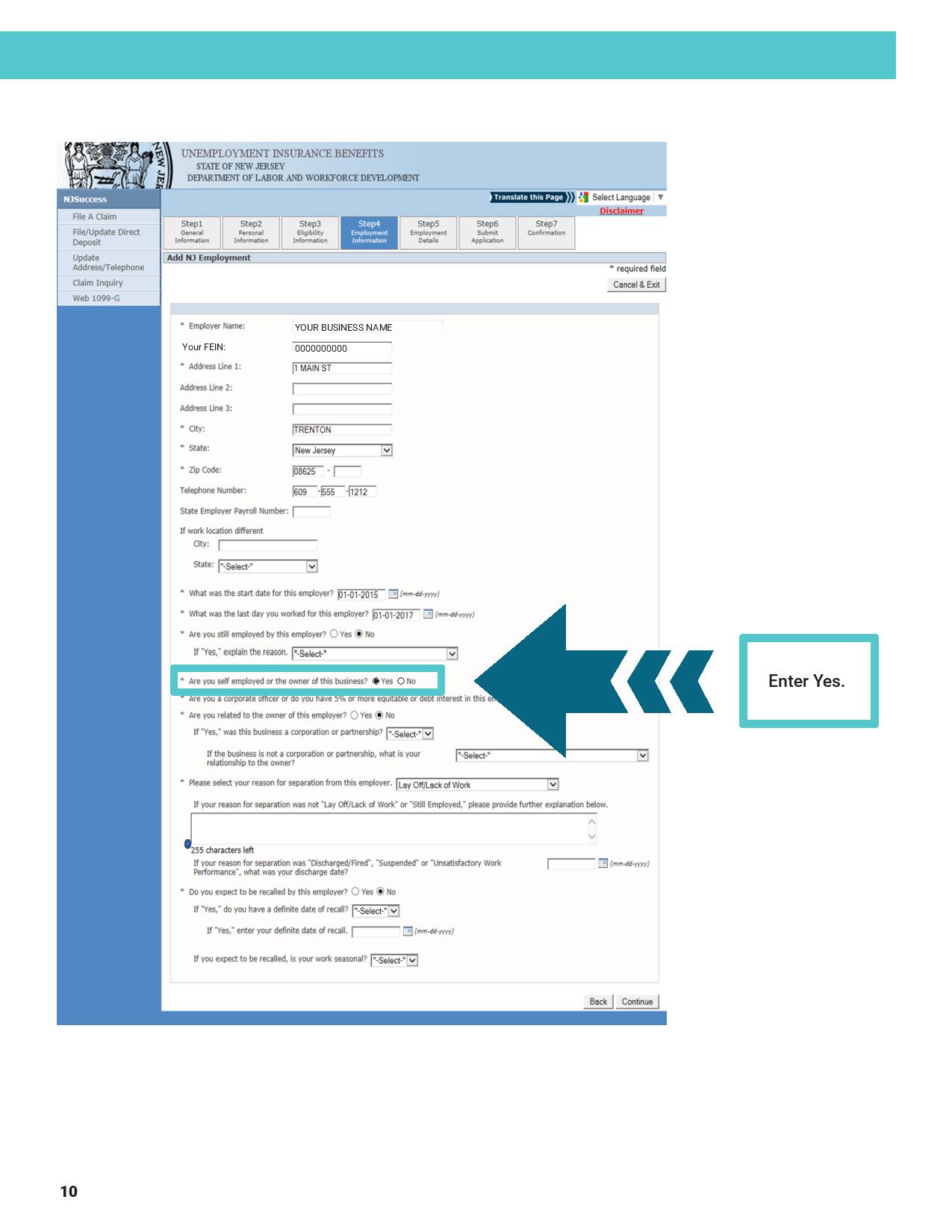

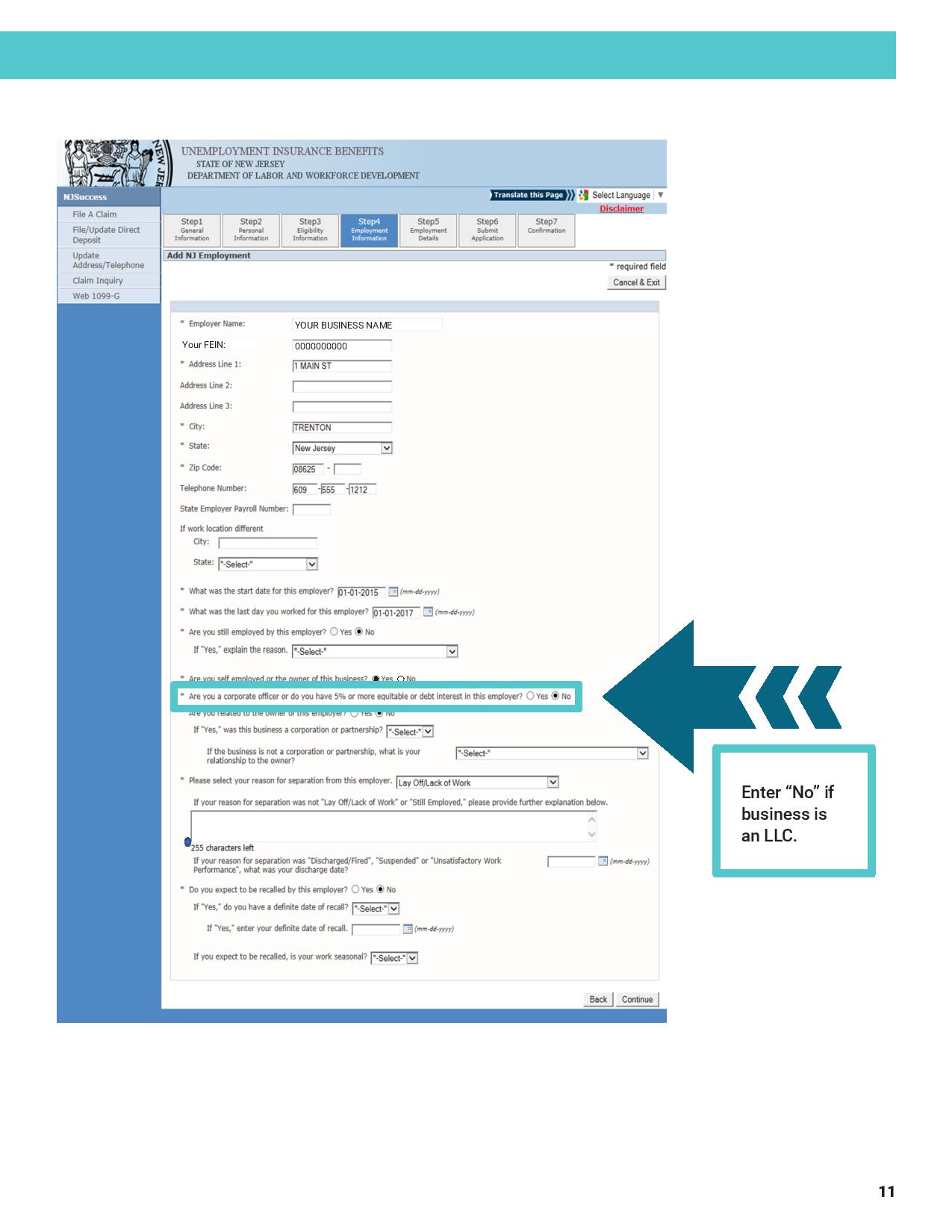

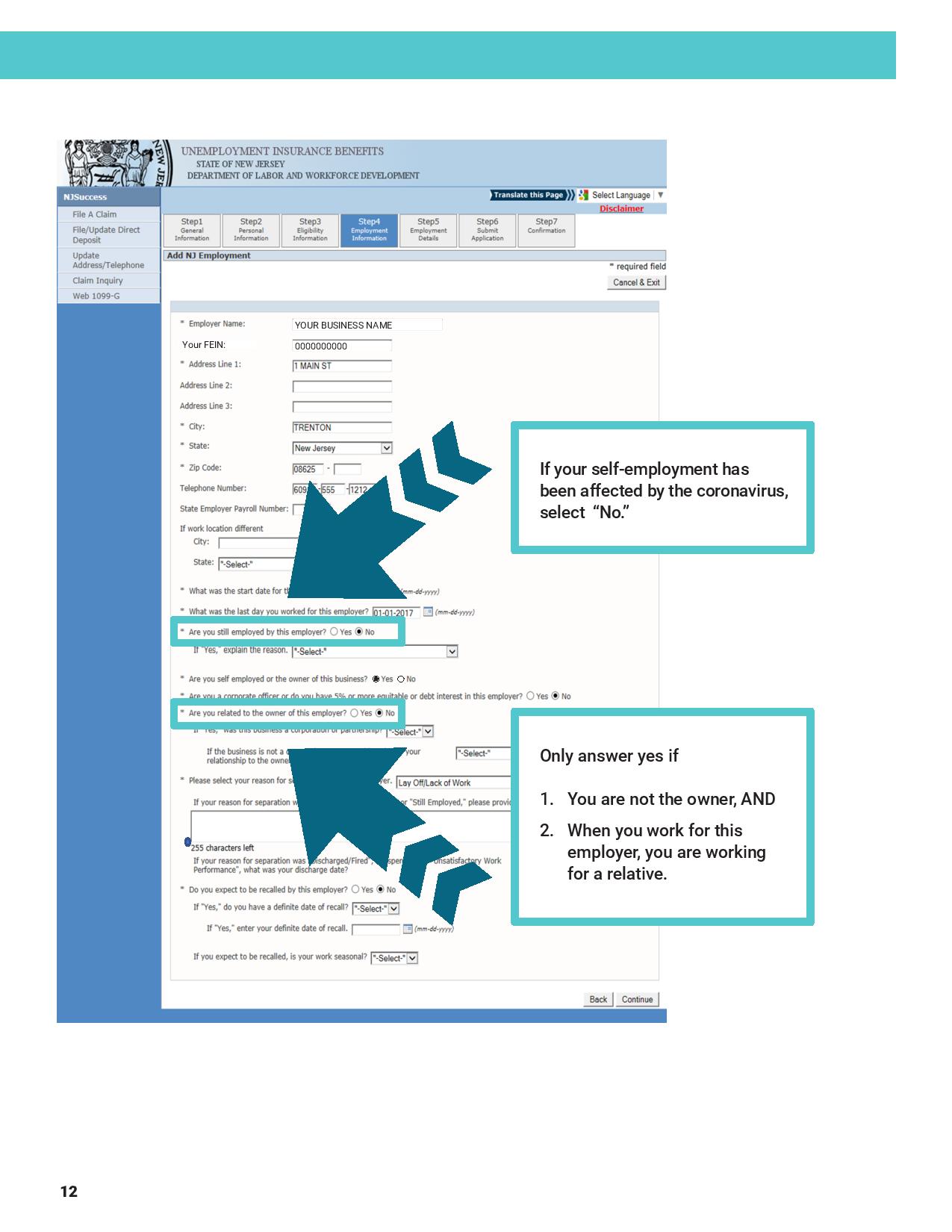

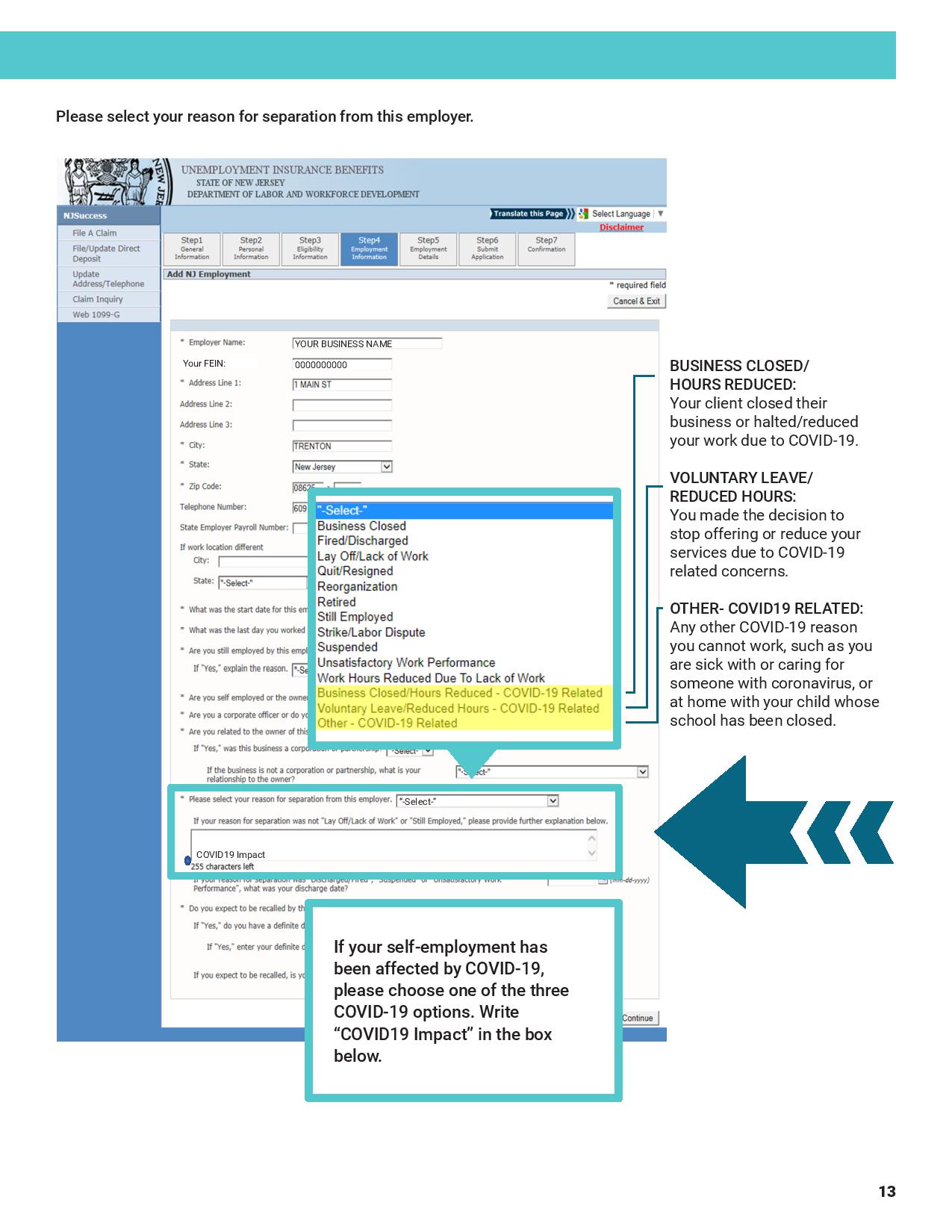

-If you choose to file now, refer to our application guide for self-employed workers to ensure that you answer

application questions correctly.

-Apply online at myunemployment.nj.gov.

-Begin collecting two years of income-history demonstrating documents, such as tax returns.

4. I went ahead and applied online for unemployment when I heard about the CARES Act and I haven’t heard back yet. What do I do? If you received a confirmation number, you do not have to take any action - your claim will be reviewed by Unemployment Insurance staff. Our system is experiencing record levels of demand and all in-person services statewide are currently closed due to COVID-19. If your application was not successful, please keep trying, and see the application guide in #3 above. You will not lose a day’s benefits as all claims will be backdated to your first day of employment loss.

MISCLASSIFICATION

Misclassification is the practice of illegally and improperly classifying workers as independent contractors,

rather than employees.

6. I believe I’ve been misclassified as an independent contractor, and I lost my work due to coronavirus. What should I do? The New Jersey Department of Labor is currently working with the U.S. Department of Labor to develop the process to assess your application for this new federal program of Pandemic Unemployment Assistance. In the meantime, applying for unemployment insurance is the necessary first step. See #3 for our application guide. If you file now, Unemployment Insurance staff will first assess your application and your relationship to your employer. In addition, you may report your misclassification by emailing: [email protected].

THE FAMILIES FIRST CORONAVIRUS RESPONSE ACT: EMERGENCY PAID SICK LEAVE AND EXPANDED FAMILY & MEDICAL LEAVE FOR THE SELF-EMPLOYED

The federal Families First Coronavirus Response Act took effect April 1, 2020 and gives certain workers

access to emergency paid leave to care for themselves or a loved one, or to care for their children at home,

due to coronavirus. For additional guidance, see USDOL’s FAQs and NJDOL’s publication What NJ Workers

Need to Know About the Families First Coronavirus Response Act. This is a federal program; NJDOL is

providing this information as a resource to our workers. Questions should be directed to the USDOL and IRS.

7. I’m self-employed, an independent contractor, a gig worker, or a platform worker. What do I get from the Families First Coronavirus Response Act? Although you will not receive emergency paid sick leave or emergency FMLA childcare leave as direct payments, you can obtain equivalent tax breaks. You can receive a tax credit worth up to 80 hours of emergency paid sick leave to care for yourself or a loved one impacted by coronavirus; and up to 12 weeks (2 weeks unpaid, 10 weeks paid) emergency FMLA childcare leave to care for your child at home because they have no school or childcare due to coronavirus. This credit is applied against your annual income taxes and it is refundable. This means that you will get a rebate if your sick leave/childcare leave expenses were greater than your tax bill. Learn more from the IRS. The emergency paid leave must be taken between April 1, 2020 and December 31, 2020.

8. How is a gig worker/self-employed worker defined in the federal FFCRA law? The law permits a worker who “carries on a trade or business,” and who would be entitled to FFCRA paid leave if she or he were an employee of an employer, to receive tax breaks.

9. What kinds of records do I have to keep in order to receive the tax credit? It is recommended that you keep the following records:

a. Documentation to show how you determined the amount of sick leave and childcare leave that you used,

including records of work and telework;

b. Documentation to show how you determined these expenses;

c. Copies of any completed IRS Forms 7200 (“Advance Payment of Employer Credits Due to COVID-19”)

that you submitted to the IRS;

d. Copies of the completed IRS Forms 941 (“Employer’s Quarterly Federal Tax Return”) you submitted to the IRS; and,

e. Any other relevant documents requested by the IRS. For more information, please consult: https://www.irs.gov/coronavirus/new-employer-tax-credits

If you have never created an account with myunemployment.nj.gov, follow the instructions here to create an account: https://myunemployment.nj.gov/labor/myunemployment/before/createaccount/index.shtml.