In order to be eligible for a Main Street Lending Program loan, a business must:

• Have been established before March 13, 2020

• Not be an ineligible business according to Small Business Administration (SBA) regulations

• Have no more than 15,000 employees or 2019 annual revenues of no more than $5 billion

• The SBA’s affiliation rules apply in determining the employee and revenue count

• In counting employees, the Main Street Lending Program advises businesses to refer to SBA regulations by counting all full-time, part-time, seasonal, or otherwise employed persons, excluding volunteers and independent contractors

• Have been created or organized in the U.S. with significant operations in and a majority of its employees based in the U.S.

• Not also participate in one of the other Main Street loan facilities, as well as the Primary Market Corporate Credit Facility

• Note: Businesses that received support through the SBA Paycheck Protection Program (PPP) are eligible to receive a Main Street loan

• Not have received specific support pursuant to the CARES Act (Subtitle A of Title IV for air carriers, air cargo, and businesses critical to national security)

All of the above criteria must be met in order to be eligible.

See “Additional Borrower Criteria” section for more information

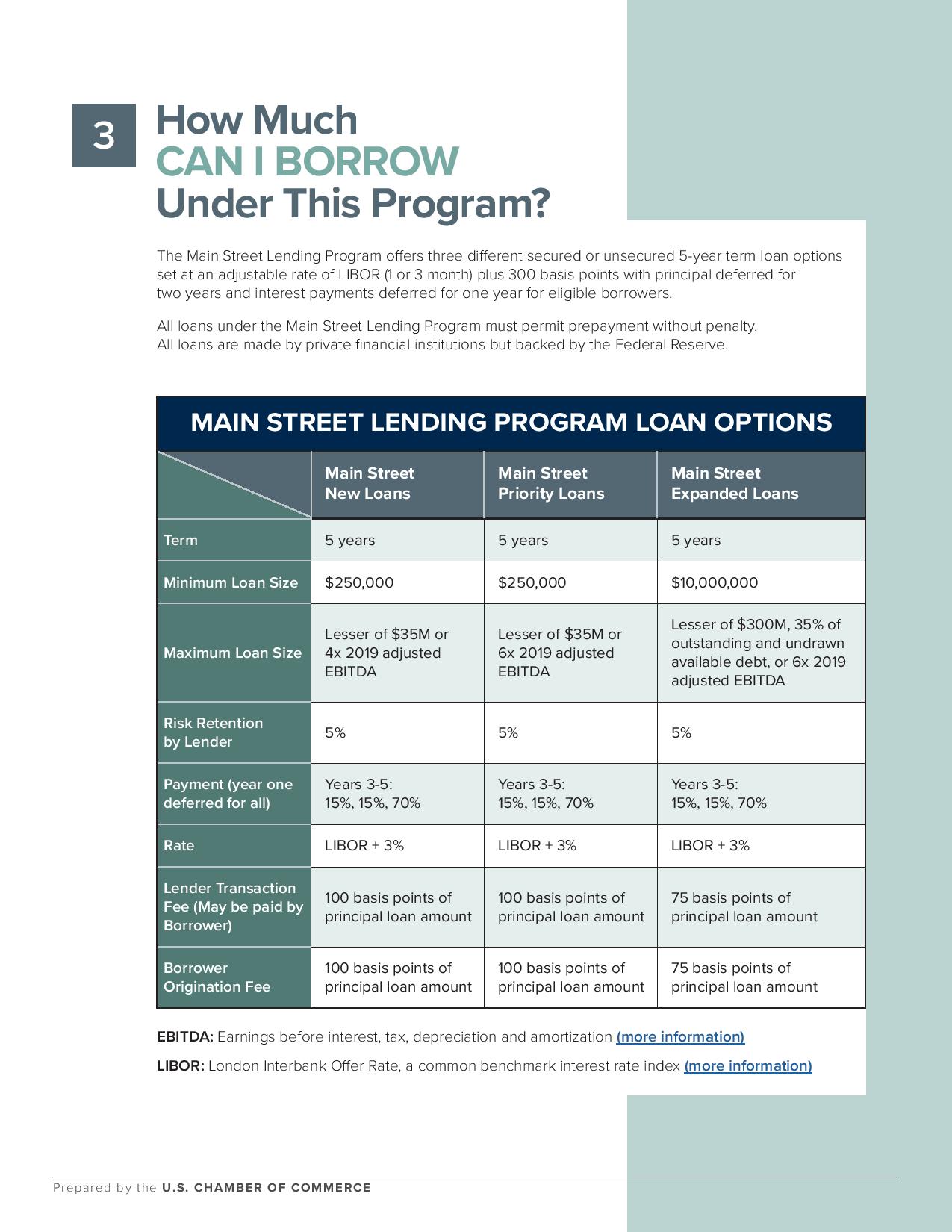

EBITDA: Earnings before interest, tax, depreciation, and amortization (more information)

LIBOR: London Interbank Offer Rate, a common benchmark interest rate index (more information)

For more information, check out the Federal Reserve’s Program Details and FAQs.