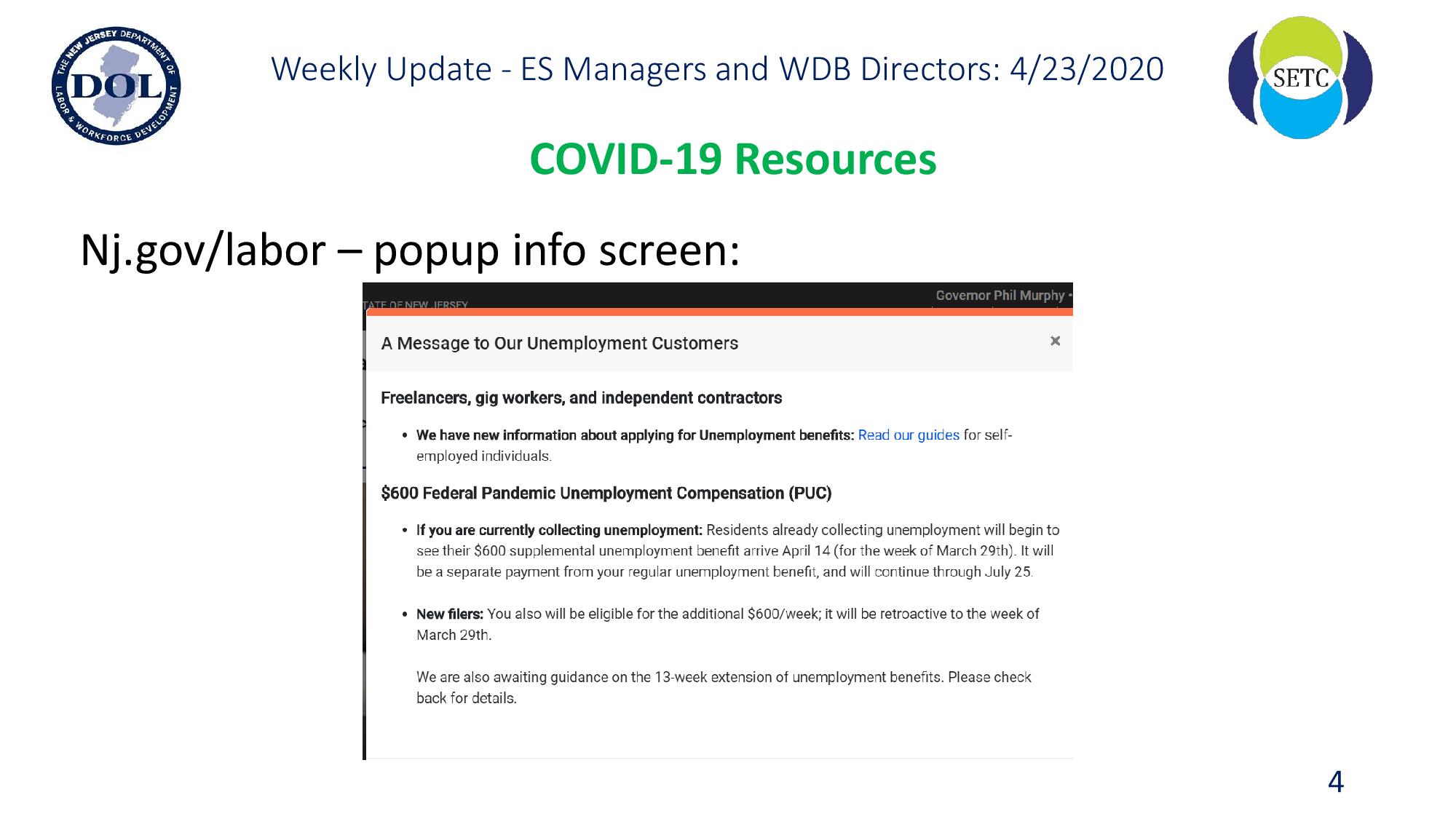

COVID-19 Resources

USDOL/National

-UIPL 17-20 -CARES Act of 2020—Pandemic Emergency Unemployment Compensation (PEUC) ETA Advisory database at https://wdr.doleta.gov/directives/corr_doc.cfm?DOCN=8452.

-USDOL Resources for Coronavirus: https://www.dol.gov/coronavirus

-Federal Business Assistance: Concerns have been raised regarding the exhaustion of dollars made available for businesses, particularly in the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loans (EIDL). The new stimulus package (approved by the Senate; now up for a House vote and Presidential signature) will provide an additional $310B for PPP and $60B for EIDL. The bill also includes approximately $100B for hospitals and increased coronavirus testing. This is moving as we speak. Information (as of 4/22) available at:

https://fortune.com/2020/04/21/small-business-loans-extra-ppp-coronavirus-stimulus-cares-act-sba/

NJ Specific Info –Job Seekers

NJ Jobs and Hiring Portal: Jobs.covid19.nj.gov

UI FAQs and NJDOL Scenarios and Benefits Info: https://www.nj.gov/labor/worker-protections/earnedsick/covid.shtml

UI Info for the Self-Unemployed: https://myunemployment.nj.gov/independentcontractors.shtml

NJ Specific Info –Businesses

-NJEDA-Information for NJ Businesses on the COVID-19/Novel Coronavirus Outbreak https://www.njeda.com/about/Public-Information/Coronavirus-Information

-NJ Economic Development Association (NJEDA) Helpline: #844-965-1125

-Small Business Administration (SBA) Helpline: #800-659-2955

-NJ Business Action Center (NJBAC)Help Line: 1-800-Jersey-7

-NJBAC Website: https://nj.gov/state/bac/

-Use cv.business.nj.gov to access information, the Wizard tool and the chat bot.

-NJBAC Business FAQs: https://faq.business.nj.gov/en/collections/2198378-information-for-nj-businesses-on-the-coronavirus-outbreak

Future Impacts

-Heldrich Center article published 4/21/2020 considers the findings of research about COVID-19 impacts:

-160 workforce staff from 7 states, and

-3 roundtables with 31 individuals where they discussed their experiences in transitioning to remote teams providing virtual services

-Suddenly Virtual: Delivering Workforce Services in the COVID-19 Environment: https://medium.com/@hcwd/suddenly-virtual-delivering-workforce-services-in-the-covid-19-environment-9766590413b6

NJ DHS Info

-March 18, 2020 –The Department of Human Services waived requirements for childcare and cash assistance programs, including:

-Automatically extending for 60 days WorkFirst New Jersey cash assistance to individuals whose case is up for renewal in March or April;

-Extending all Emergency Assistance cases through April 30; and

-Deeming the current state of emergency as a good cause exemption for the work requirements in WorkFirst New Jersey and SNAP and suspending all adverse actions for non-compliance.

-More information at: https://www.state.nj.us/humanservices/news/press/2020/approved/20200318b.html

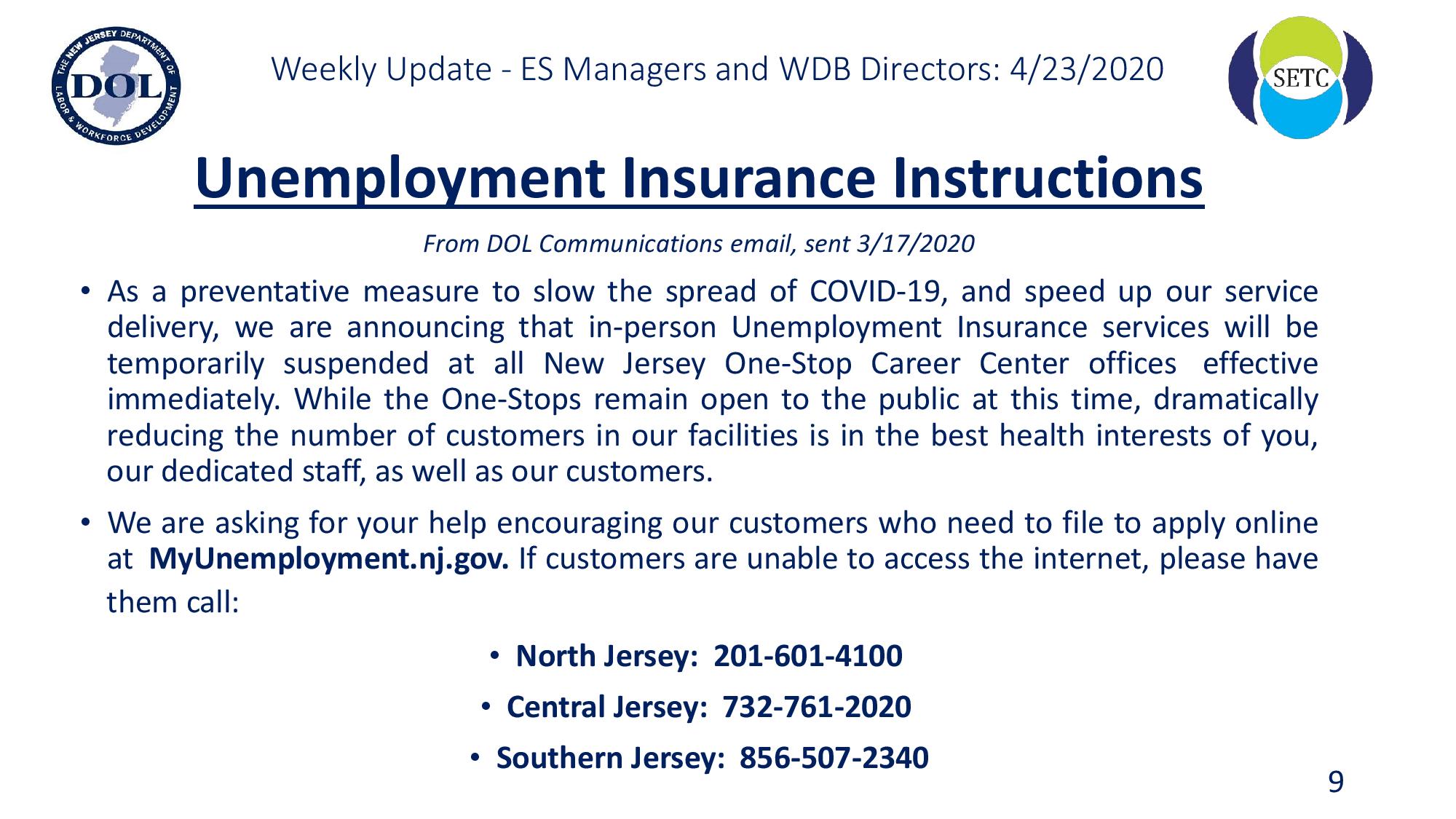

Unemployment Insurance Instructions (From DOL Communications email, sent 3/17/2020)

-As a preventative measure to slow the spread of COVID-19, and speed up our service delivery, we are announcing that in-person Unemployment Insurance services will be temporarily suspended at all New Jersey One-Stop Career Center offices effective immediately. While the One-Stops remain open to the public at this time, dramatically reducing the number of customers in our facilities is in the best health interests of you, our dedicated staff, as well as our customers.

-We are asking for your help encouraging our customers who need to file to apply online at MyUnemployment.nj.gov.

If customers are unable to access the internet, please have them call:

-North Jersey:201-601-4100

-Central Jersey:732-761-2020

-Southern Jersey:856-507-2340

NJDOL Workforce Updates

Hugh Bailey - Assistant Commissioner, Workforce Development

NJ Department of Labor and Workforce Development

Email: [email protected]

Phone: 609-984-9414

Q. Can states or grantees waive procurement requirements?

Response: In accordance with OMB Memorandum M-20-17, grantees may conduct procurements under the public emergency provision (2 CFR 200.320(f)(2)). Grantees can waiver the procurement requirements contained in 2 CFR 200.319(b) regarding geographical preferences and 2 CFR 200.321 regarding contracting with small and minority businesses, women's business enterprises, and labor surplus area firms. Grant recipients are expected to use sound fiscal prudence to maximize value for each taxpayer dollar spent. These exceptions are time limited and will be reassessed by ETA within 90 days of the OMB Memo M-20-17 dated March 19, 2020, that is, by mid-June.

Q. How does a state submit an emergency disaster recovery DWG application?

Response: With the public health declaration and the FEMA emergency declaration, all states, outlying areas and Indian tribal entities under the Stafford Act are eligible to apply for Disaster Recovery DWG funds. Applicants may request Disaster Recovery DWGs through an abbreviated emergency application to facilitate timely delivery of DWG assistance in response to a disaster event. These applications should be submitted to ETA within 15 days of the declaration of a qualifying disaster declaration by FEMA or other Federal agency having jurisdiction over the disaster. With appropriate justification, applicants may request an exception to this requirement, to allow for the submission of the emergency application within a reasonable timeframe after Day 15. Applicants also have the option to submit a full application containing a budget and plan, in lieu of an emergency application. Within 60 business days following an award of Disaster Recovery DWG funds requested via an emergency application, the grantee must modify the grant to provide a full application. This includes a budget, implementation plan, and a list of worksites where the disaster relief work will be performed. ETA may also require the grantee to submit additional information per the special conditions of the initial DWG award. For additional information on the DWG application process, go to the following link: https://www.doleta.gov/grants/application_howto.cfm (This information also published in TEGL 12-19)

Q. Can ETA release the full amount approved for DWG awards?

Response: With the public health declaration and the FEMA emergency declaration, all states, outlying areas and Indian tribal entities are eligible to apply for Disaster Recovery DWG funds. Applicants may request Disaster Recovery DWGs through an abbreviated emergency application to facilitate timely delivery of DWG assistance in response to a disaster event. These applications should be submitted to ETA within 15 days of the declaration of a qualifying disaster declaration. With appropriate justification, applicants may request an exception to this requirement, to allow for the submission of the emergency application within a reasonable timeframe after Day 15. Applicants also have the option to submit a full application containing a budget and plan, in lieu of an emergency application. Within 60 business days following an award of Disaster Recovery DWG funds requested via an emergency application, the grantee must modify the grant to provide a full application. This includes a budget, implementation plan, and a list of worksites where the disaster relief work will be performed. ETA may also require the grantee to submit additional information per the special conditions of the initial DWG award. For additional information on the DWG application process, go to the following link: https://www.doleta.gov/grants/application_howto.cfm

Q. Can ETA provide clarifications on the use of funds for layoff aversion?

Response: Training and Employment Guidance Letter (TEGL) 19-16 contains information on the use of Dislocated Worker (DW) funds for layoff aversion activities. Section 18 of the TEGL covers the Rapid Response program and how Rapid Response funds can and should be used to conduct layoff aversion activities. In addition, DW funds may be used for incumbent worker training (see section 13 of the TEGL). Additionally, states have the flexibility to utilize the Governor's Reserve to conduct layoff aversion activities.

Q. Can On-The-Job Training (OJT) funds be used for layoff aversion activities for current workers in the same company?

Response: Employed workers may be eligible for WIOA-funded OJT if the requirements of 20 CFR 680.710 are met. Additionally, rapid response or statewide WIOA funds may be used for layoff aversion activities including incumbent worker training. See TEGL 19-16, Section 18 for current flexibilities related to rapid response activities. States and local areas may also utilize incumbent worker training for layoff aversion activities as discussed in TEGL 19-16 Section 13.

Q. Can states transfer funds from the WIOA Youth program to the WIOA Dislocated Worker program?

Response: Under current law, states may not transfer funds from the WIOA Youth program, but may transfer funds between the WIOA Adult and Dislocated Worker programs. Such transfers are within the WIOA waiver authority under Section 189. ETA will consider any waiver that a state proposes, and evaluates each waiver on a case by case basis according to the criteria specified in statute and listed at https://www.dol.gov/agencies/eta/wioa/waivers. States may request waivers for transfers from the Youth program or for any other provisions. However, states should be ready to describe how quality services will still be provided to out-of-school youth.

Q. Can ETA provide relief on out-of-school youth (OSY) 20% Work Experience expenditure requirement?

Response: ETA acknowledges work experiences for youth during this time period may be harder to provide. Program expenditures on this program element may include more than just wages paid to youth. Allowable expenditures may include items such as:

Wages or stipends paid for participation in a work experience;

Staff time working to identify and develop a work experience opportunity, including staff time spent working with employers to identify and develop the work experience;

Staff time working with employers to ensure a successful work experience, including staff time spent managing the work experience;

Staff time spent evaluating the work experience;

Participant work experience orientation sessions;

Employer work experience orientation sessions;

Classroom training or the required academic education component directly related to the work experience;

Incentive payments directly tied to the completion of work experience; and

Employability skills or job readiness training to prepare youth for a work experience.

When determining the types of expenditures that are allowable to help meet this requirement, additional information can be found in TEGL 08-15 and TEGL 21-16, p.15. If state and local areas do not meet this requirement at the end of their period of performance, the Department will follow standard monitoring procedures for this program element.

Q. If we are closing our AJC, should we inform anyone?

Response: Yes, please inform your Regional Office of AJC or State Workforce Agency (SWA) closures. ETA will use this information to update the Service Locator website (https://www.careeronestop.org/LocalHelp/service-locator.aspx), and to update information disseminated by the Toll Free Helpline.

Senior Community Service Employment Program (SCSEP)

Q: We are in an area with confirmed cases of novel coronavirus disease (COVID-19) and/or an area that is taking broad public health measures to prevent the spread of the virus. Are we allowed to pay participants whose host agency assignments or paid training activities are impacted by COVID-19, particularly in situations where regional or localized quarantine efforts prevent participants from attending training sites in person?

Response: We recognize that the current COVID-19 outbreak presents unique challenges for SCSEP grantees and participants. The program’s participants are particularly vulnerable for several reasons, including their reliance on SCSEP wages and benefits, as well as their age, which appears to place them in higher risk categories for complications due to COVID-19 disease. Grantees can act to minimize disruptions in the payments to participants of SCSEP wages and benefits, and to minimize the exposure risk encountered by SCSEP participants and grant staff. In addition, please refer to the Centers for Disease Control page on the novel coronavirus for the latest updates and medical advice: https://www.cdc.gov/coronavirus/2019-ncov/index.html.

Note that, even in the unusual situation prompted by community transmission of the novel coronavirus, your SCSEP grant remains subject to the laws, regulations, and policies that apply to SCSEP, including the authorizing statute (Older Americans Act, Title V, 42 U.S.C. sec. 3056, et seq., as amended), the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Grant Guidance at 2 CFR Part 200 and 2 CFR Part 2900), SCSEP regulations (20 CFR Part 641), applicable DOL guidance, and the terms and conditions specified in your grant award. However, depending on the situation in your communities, you have several options that may minimize disruption to SCSEP participants while still adhering to the applicable rules. The options described below, alone or in combination, should help to prevent disruptions to many participants affected by the emergency. However, if for some reason, a participant goes more than three days without pay due to the crisis, such participant must be placed on an approved break until alternative arrangements are made in order to avoid a negative impact to the participant’s durational limit calculation.